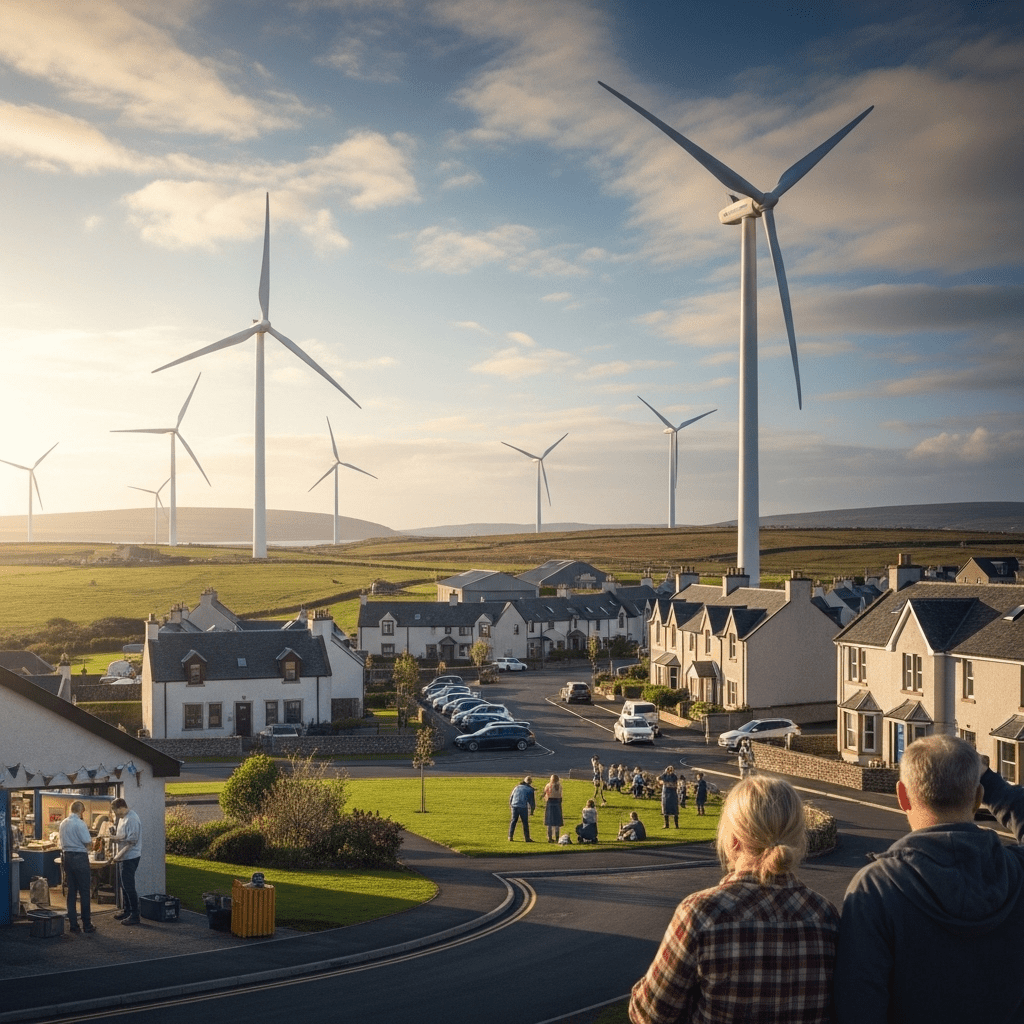

A groundbreaking renewable energy initiative is transforming the industry in Scotland, as all profits from the new Orkney windfarm are set to benefit the local community directly. This innovative approach aims to deliver lasting economic, social, and environmental returns to Orkney residents—a model that is being closely watched by investors, policymakers, and energy analysts across Europe.

How All Profits From New Orkney Windfarm Will Empower Local Communities

Traditionally, profits from large-scale renewable energy projects flow to private stakeholders or external investors. However, the Orkney windfarm, backed by a community-owned cooperative, is reversing this trend by ensuring that every pound generated is reinvested locally. The groundbreaking initiative is expected to channel millions back into Orkney over the project’s lifespan, supporting infrastructure, green jobs, education, and community welfare programs.

Project leaders assert that the new model is “much fairer” than previous approaches. By directly benefiting those most impacted by land use and environmental changes, it addresses community concerns commonly associated with windfarm developments. This plan is aligned with a growing movement toward ‘energy localism’, where communities control and profit from their own resources.

Financing, Ownership Structure, and Returns

The Orkney windfarm is the result of several years of local campaigning and strategic partnership. The cooperative ownership model has enabled over 2,000 Orkney households and businesses to buy shares and guarantee a stake in ongoing returns. According to the scheme’s financial disclosures, projected profits could reach upwards of £5 million per year when the farm is at full operational capacity.

Investors, including local pension funds and ethical finance institutions, are viewing this as a case study in sustainable finance. The transparent financial structure not only boosts local economic resilience but also provides a scalable blueprint for other regions aiming to combine renewable energy growth with community wealth.

Economic and Environmental Impact of All Profits From New Orkney Windfarm

The commitment to keeping all profits from the new Orkney windfarm within the community translates into tangible economic advantages. Analysts estimate job creation in both skilled and unskilled sectors, ranging from maintenance and technical operations to community project management. The project is also expected to strengthen supply chains for local businesses and attract further green investment to Orkney.

Environmentally, the windfarm is projected to offset tens of thousands of tonnes of carbon dioxide annually—a significant contribution to Scotland’s national net-zero targets. The local reinvestment of profits is designed to fund additional carbon-reduction programs, energy efficiency upgrades, and support for emerging clean technologies.

Comparison With Traditional Windfarm Models

Most UK renewable energy projects remain in the hands of a small group of corporate entities or multinationals, whose profits may benefit far-removed shareholders. In contrast, Orkney’s model ensures transparent, regular reporting and direct accountability to the residents—a move that is likely to boost trust and public acceptance, which has been a challenge for other developments.

This approach complements the growing popularity of ESG (Environmental, Social, and Governance) investing, echoing trends discussed in global sustainable finance and impact measurement. By directly tying financial success to community prosperity, stakeholders create both sustainable growth and strong ESG credentials.

Future Prospects and Replicability of the Orkney Model

The success of the all profits from new Orkney windfarm scheme could have far-reaching implications. Policymakers are already exploring how similar models could be replicated in other communities, not only in Scotland but throughout the UK and Europe. The keen interest from NGOs, municipal authorities, and beyond signals the potential for a broader shift in how renewable energy projects are structured and governed.

Financial analysts at ThinkInvest.org note that such models mitigate community opposition—a common bottleneck in energy project planning. By proving that direct local returns yield both financial and social gains, Orkney’s strategy may set a new industry benchmark for community-owned renewables.

Challenges and Considerations

Despite its promise, the model is not without challenges. Securing initial funding, managing distribution of returns, and balancing long-term investment with short-term community needs all require robust governance and transparent oversight. However, with the backing of experienced energy cooperatives and input from local leaders, the Orkney project is positioned to navigate these hurdles effectively.

For investors, particularly those interested in alternative asset strategies, such community-first renewable initiatives may offer both steady returns and positive societal impact—an increasingly attractive dual benefit in a fast-evolving ESG landscape.

Conclusion: A Template for a Fairer Renewable Future

The decision to direct all profits from the new Orkney windfarm back to local residents marks a pivotal evolution in how green energy projects are financed and run. As the energy sector confronts mounting calls for fairness, transparency, and sustainability, Orkney’s approach offers a replicable template for regions worldwide. Investors, policymakers, and community leaders alike will continue to monitor this “much fairer” model as it sets new standards for equitable growth in the renewable economy.