New Zealand Prime Minister Christopher Luxon ($NZEQTY) has pledged to increase the national pension savings scheme, aiming for a 25% surge in contributions by 2027. The policy shift, announced today, sets the stage for significant changes to KiwiSaver and retirement planning. Investors are watching for unexpected macroeconomic impacts as fiscal details emerge.

Luxon Unveils 25% KiwiSaver Boost With Fiscal Targets

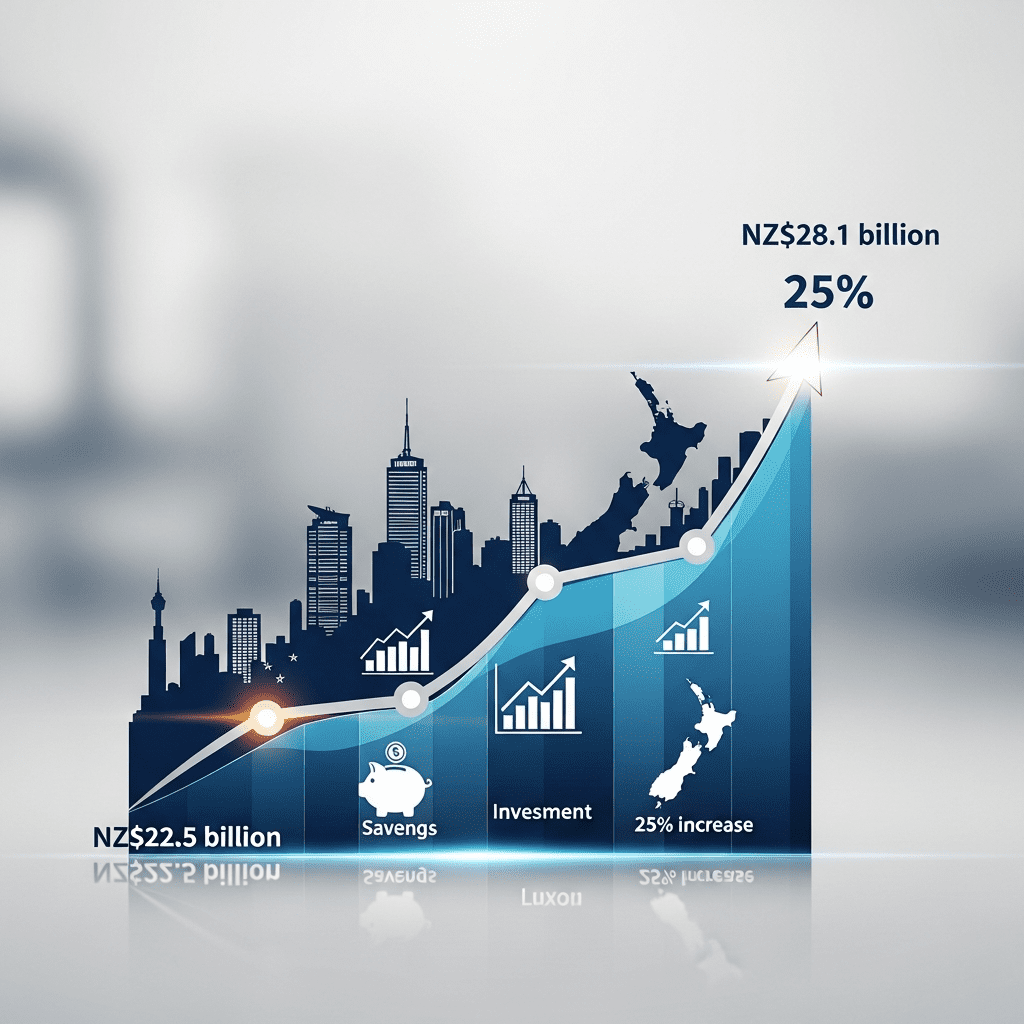

In a closely watched policy address, Prime Minister Christopher Luxon ($NZEQTY) announced a comprehensive plan to increase New Zealand’s pension savings rates. The government aims to raise aggregate KiwiSaver contributions from their current NZ$22.5 billion (2024, IRD data) to NZ$28.1 billion by the end of 2027, marking a 25% nominal increase. According to the New Zealand Treasury, KiwiSaver participation stands at 3.2 million members out of a 5.2 million population, with average personal contribution rates remaining below the OECD average of 7.4%. Luxon’s proposal, which includes phased mandatory contribution rate hikes—from the standard 3% to 4.5% by 2027 for employees—reflects a national commitment to address long-term retirement security. The government projects the package will add 0.3% to annual GDP growth by 2028, citing figures reported by Reuters and recent Treasury briefings. The policy’s comprehensive scope also covers employer match increases and greater tax incentives for voluntary contributions, to be funded through projected surplus from goods and services tax (GST) receipts, which reached NZ$24.7 billion in FY2024 (NZ Treasury).

Pension Savings Reform Reverberates Across Financial Markets

The announcement has sent ripples through New Zealand’s financial sector, with listed asset managers such as AMP NZ ($AMP.NZ) and ANZ Group ($ANZ.AX) seeing intraday share price gains of 2.3% and 1.7%, respectively, on the NZX and ASX following the news. KiwiSaver funds, which collectively managed NZ$104.5 billion at FY2024 year-end (Financial Markets Authority), stand to see substantial inflows as a result. Analysts at Forsyth Barr expect an average NZ$1.15 billion in additional annual inflows to domestic equities and fixed income assets starting in 2026. The Reserve Bank of New Zealand’s latest Financial Stability Report (October 2024) notes that “higher compulsory savings will bolster the pool of long-term domestic capital, potentially reducing sovereign yield volatility and providing a tailwind to local corporate credit markets.” Sector observers emphasize the likely positive effect on domestic banking deposit growth and insurance policy uptake. The broader pension reform trend echoes international developments, with Australia’s superannuation system having reached over AU$3.5 trillion in assets, underlining the growing strategic importance of national retirement saving vehicles (Bloomberg, October 2024).

Investor Responses: Navigating Opportunities and Portfolio Risks

The move to accelerate KiwiSaver contributions creates both opportunities and challenges for investors. Retail savers and financial advisers are poised to benefit from increased employer-matching rates, while institutional investors and global asset managers assess the impact of higher domestic allocation mandates. For those tracking the New Zealand equity market, the announcement may lift valuations of exchange-listed managers and create stronger demand for listed property, infrastructure, and growth stocks. With the Financial Markets Authority reporting a 12.8% 5-year CAGR in KiwiSaver fund balances, the policy’s scale could compound this trend. However, some market participants remain wary of crowding-out effects, fearing a shift of capital from other asset classes such as direct property or term deposits. Volatility might rise in segments where fund flows rapidly accelerate, requiring tactical rebalancing. Investors are also advised to monitor the performance of currency-sensitive sectors; persistent inflows into KiwiSaver may buoy the NZD/USD, affecting offshore return expectations in the foreign exchange market. As global pension funds re-rate New Zealand’s sovereign and corporate debt, cross-border capital flows could intensify, according to Jarden brokerage (November 2024). For deeper context, visit ThinkInvest’s financial news analysis on policy reforms and asset allocation impacts.

Expert Outlook: Will Higher Pension Savings Shift Market Dynamics?

Domestic and international analysts broadly welcome Luxon’s pension reform, though the forward outlook reveals varying degrees of optimism. Most economists agree that the policy could improve New Zealand’s long-term fiscal health and resilience to demographic aging, echoing OECD warnings about the rising old-age dependency ratio (expected to exceed 35% by 2030, Stats NZ). Westpac’s market strategists project “a stronger local bid for high-grade government and corporate bonds” as KiwiSaver flows increase, potentially compressing yields and moderating borrowing costs. Conversely, S&P Global cautions that rapid regulatory change could temporarily unsettle fund provider business models, especially if fee compression accelerates. Mercer New Zealand notes that enhanced tax incentives could especially benefit middle-income savers, though the overall macroeconomic effects will depend on wage growth, inflation trends, and global capital market conditions. As of October 2024, consumer price inflation tracked at 4.1% year-on-year, with modest wage gains of 3.3% (Statistics NZ), so cumulative real returns and KiwiSaver take-up remain under close watch. Central bank officials, speaking off record, caution that “fiscal stimulus through retirement policy must balance long-term sustainability with near-term inflationary pressures.”

Pension Savings Scheme: Investment Takeaways From Luxon’s Pledge

With Luxon pledging to increase the pension savings scheme, the stage is set for major shifts in retirement planning, capital markets, and fiscal policy. Investors should monitor the pace of regulatory rollout and fund flow dynamics, as KiwiSaver’s expanding reach could strengthen domestic asset performance while introducing new sector and currency risks. Diversifying across local and global asset classes—and reviewing fund provider strategies as competition intensifies—will be critical in navigating New Zealand’s evolving investment landscape. For more insights, explore ThinkInvest’s in-depth coverage on pension reforms and market-moving policy changes.

Tags: New Zealand, pension savings, KiwiSaver, Luxon, retirement policy, financial markets, investor strategies, economic reform, GDP growth, fiscal policy