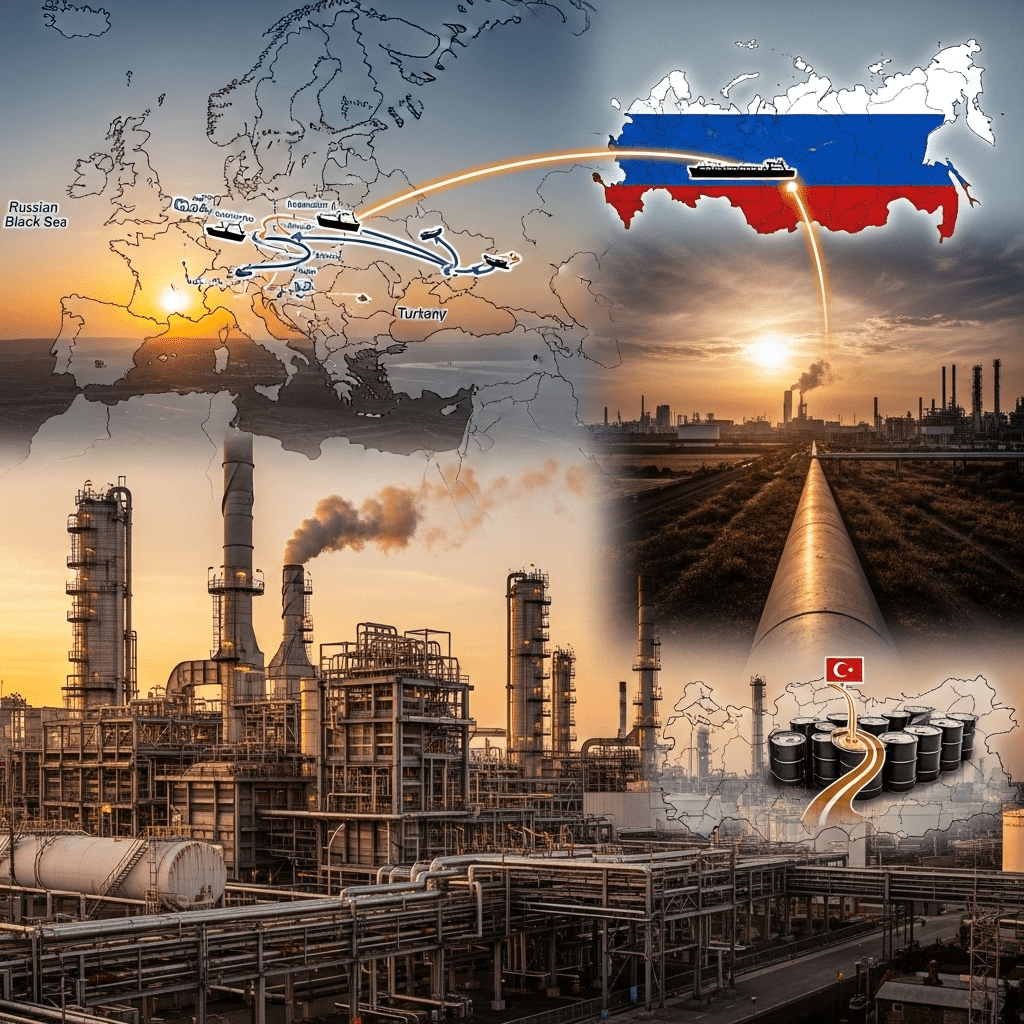

No Exit from Urals remains an apt description for Turkey’s energy landscape in 2025, as the nation’s refineries continue their reliance on Russian crude supplies. Despite shifting geopolitical tides and evolving market pressures, Turkey’s deep integration with Russian oil exports shows few signs of abating, shaping regional energy dynamics and investor strategies.

No Exit from Urals: Turkey’s Continued Dependence on Russian Oil

Since the outset of intensified Western sanctions on Russia, observers have speculated about the potential for Turkey to diversify its supply away from Urals crude. Yet, market data tells a consistent story: Turkey’s refiners are still largely dependent on Russian oil flows. The country’s largest refineries, including STAR and Tupras, source much of their feedstock from Russia due to competitive pricing, favorable transport logistics, and refining configurations optimized for Urals blend.

The Turkish energy sector appears insulated from major disruption, primarily because Russian suppliers continue offering discounted barrels. These financial incentives outweigh the political risks, making Turkish importers some of the most consistent buyers of Russian crude in the region. For those seeking energy diversification strategies, Turkey’s position provides a notable case study in balancing commercial necessity with geopolitical risk.

Refinery Configurations and Supply Chain Obstacles

Turkey’s strong bond with Urals is partially technical. Local refineries have been tailored to process the particular chemical characteristics of Russian crude, requiring significant investment to switch to alternative grades. The cost and operational disruption of retooling are substantial, creating additional inertia against diversification initiatives.

Furthermore, the established supply chains—spanning rail, sea, and pipeline from Russian ports to Turkish shores—offer both savings and security of supply, factors that are doubly important in an era of market volatility. Changing these supply routes would not only entail higher costs but would also introduce logistical uncertainties.

No Exit from Urals: Implications for Turkey’s Energy Security

The persistent relationship between Turkish refineries and Russian crude raises critical questions about the nation’s energy security. While discounted Urals offers a competitive edge today, it also exposes the sector to heightened risks should supply disruptions or further sanctions occur. With limited regional energy alternatives, any significant reduction in Russian supply could force rapid—and costly—adaptations.

Geopolitical and Investment Ramifications

Turkey’s status as a strategic energy hub is both an asset and a vulnerability. While Ankara has skillfully navigated maintaining ties with both Western and Russian partners, the country’s dependency on Urals crude puts it at the heart of potential geopolitical crossfire. For global investors tracking emerging market opportunities, Turkey’s energy predicament underscores the importance of monitoring both local policies and international relations.

Moreover, Turkey’s choices could set a precedent for other nations balancing affordability, supply security, and diplomatic pressures. The evolving nature of EU sanctions, alternative supply developments in Central Asia and the Middle East, and Turkey’s progress—or lack thereof—in advancing its own energy transition will all shape the landscape for years to come.

Is There Really No Exit from Urals?

While Turkey’s refineries remain locked into Russian supply for now, incremental shifts could materialize over the longer term. Investments in refinery upgrades, increased storage capacity, and new crude blending techniques could slowly provide greater flexibility. But absent major policy changes or sustained market shocks, the fundamental economics still point back to Urals crude as the default feedstock.

In conclusion, the phrase “No Exit from Urals” captures the current reality—but also the challenges and decisions ahead for Turkey’s energy sector and its partners. As global energy markets continue to evolve, close attention to Turkey’s import slate, refinery investments, and diplomatic maneuvers will prove essential for investors and market watchers.