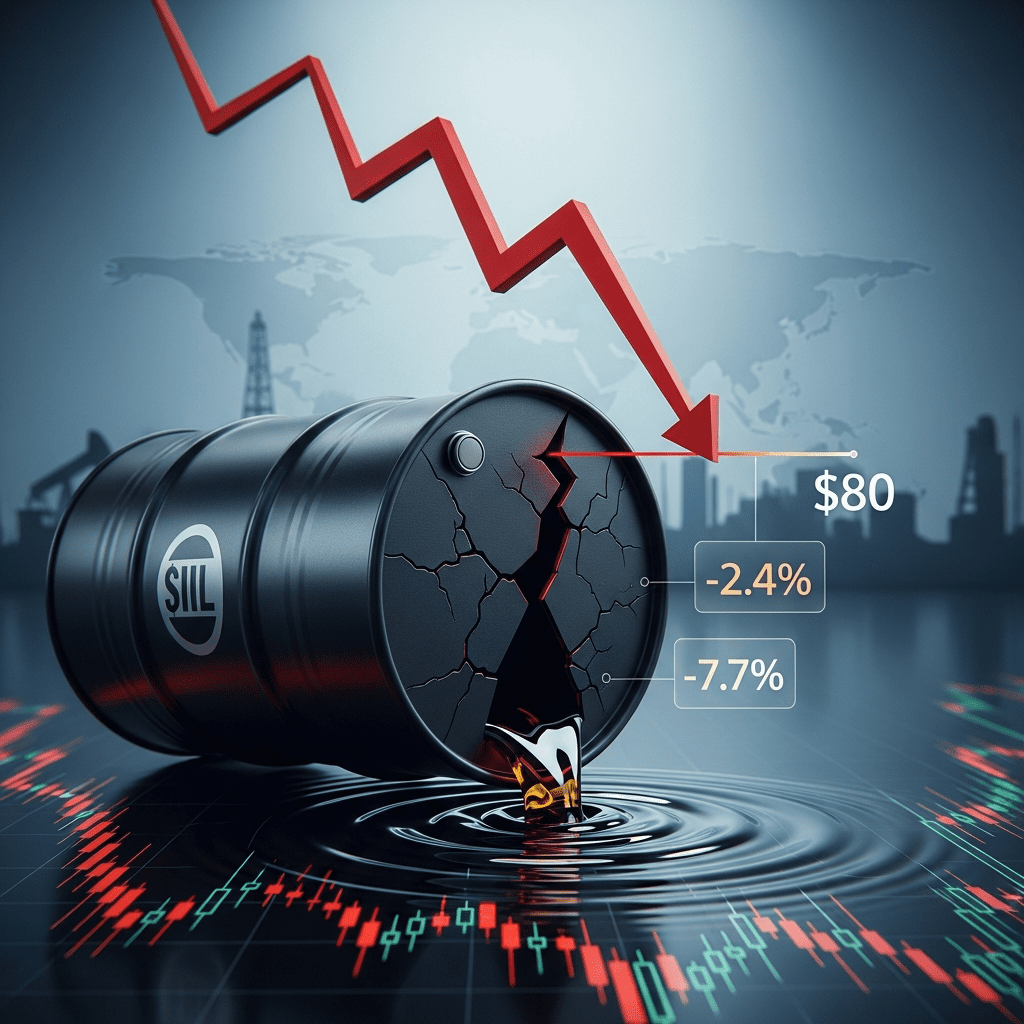

Brent crude futures ($BZ=F) dropped 2.4% to $80.72 on Thursday, revealing fresh volatility as oil heads for another weekly loss amid renewed supply concerns. West Texas Intermediate ($CL=F) also retreats, compounding this week’s surprise slide and raising urgent questions for investors.

Oil Prices Fall Nearly 8% in Two Weeks Amid Rising Output Fears

Brent crude ($BZ=F) locks in its third consecutive weekly decline, falling 7.7% since October 25, while WTI ($CL=F) sinks 8.3% over the same period, according to ICE Futures data. The declines accelerated after U.S. Energy Information Administration (EIA) figures released November 6 showed crude inventories had surged by 12.5 million barrels last week—more than triple Wall Street’s consensus. On November 6, both benchmarks touched multi-month lows, with Brent hitting $79.98 and WTI slipping to $75.15 per barrel. These moves point to the market’s acute sensitivity to changing supply dynamics as 2025 draws to a close (Reuters, 2025-11-06).

Why Global Energy Markets Are Under Pressure From Supply Glut

The latest price action underscores how markets are repricing risk amid stubbornly high global output. U.S. production remains near record highs of 13.2 million barrels per day, while OPEC+ members, including Saudi Arabia ($2222.SR), have been signaling uneven compliance with output cuts. Meanwhile, International Energy Agency (IEA) data shows global stocks have risen for three straight months despite earlier forecasts for 2025 demand growth (IEA Oil Market Report, October 2025). In contrast to the supply-driven optimism of early 2025, sluggish Chinese demand and resilient Russian exports have combined to weaken sentiment across the energy sector—dragging the S&P 500 Energy Index down 5.6% month-to-date.

How Energy Investors Can Navigate Volatility in Oil Markets

For long-term holders of energy stocks, the deepening pullback raises both caution and opportunity. Major energy names like Exxon Mobil ($XOM) and Chevron ($CVX) have seen share prices lag broader market averages, signaling a shift in sentiment since their Q3 earnings misses. Traders focusing on oil futures may find new near-term downside as technical indicators breach key $80 support on Brent. Diversified investors can offset volatility by reallocating to less cyclical sectors, as shown in recent stock market analysis. Hedging strategies—such as put options on key ETFs or diversifying into renewables—are gaining traction in professional portfolios, according to industry discussions tracked by latest financial news. As OPEC+ meets later in November, policy decisions will be a pivotal catalyst to watch closely.

What Analysts Expect Next for Crude Oil and Energy Stocks

Industry analysts observe that, despite the deep corrections, upside risks remain tied to potential OPEC+ intervention or abrupt supply disruptions. Market consensus suggests oil could remain volatile through year-end, as inventories continue to build and geopolitical risks ebb and flow. Still, few experts anticipate a sustained rebound unless either demand materially surprises to the upside or OPEC+ commits to deeper, verifiable cuts (Bloomberg, 2025-11-05).

Oil Heads for Another Weekly Loss Signals New Energy Sector Dynamics

As oil heads for another weekly loss, investors face a shifting energy sector defined by persistent oversupply and challenging demand. Monitoring OPEC+ policy moves and U.S. inventory cycles will be key for forward-looking strategy. For now, the focus keyphrase underscores a pivotal transition point—active risk management and flexible positioning are essential for navigating further market turbulence.

Tags: oil prices, $BZ=F, energy stocks, OPEC+, oil supply