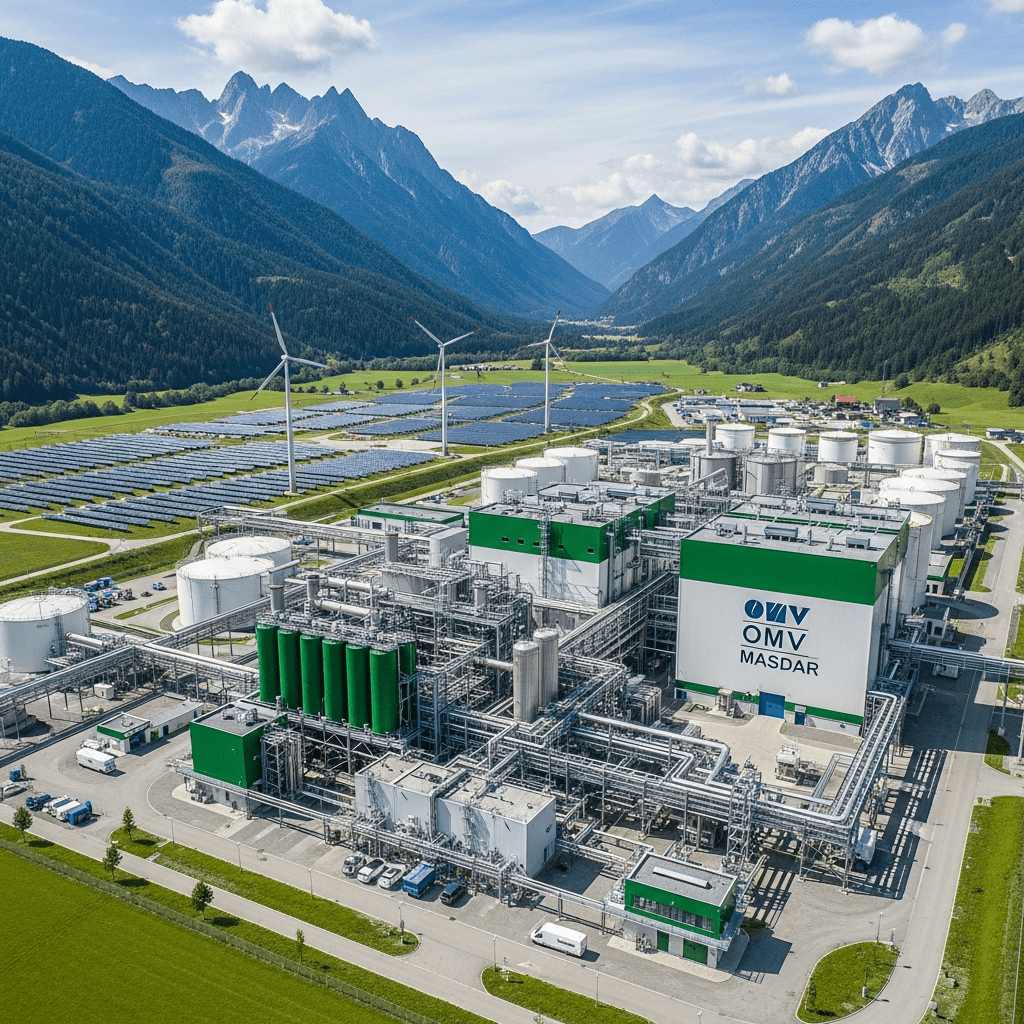

OMV AG ($OMV.VI) and Masdar have announced a €450 million joint venture to construct a 140MW green hydrogen plant in Austria, marking the country’s largest renewable hydrogen investment to date. The OMV Masdar green hydrogen Austria project aims to start production by early 2027, surprising analysts with its ambitious scale and rapid execution timeline.

OMV, Masdar Unveil €450M JV for 140MW Green Hydrogen Plant

OMV AG ($OMV.VI) and Abu Dhabi’s Masdar have secured a binding agreement for a 50:50 partnership to build Austria’s first utility-scale green hydrogen facility. The €450 million plant, to be located at OMV’s Schwechat refinery, is scheduled for operational launch in Q1 2027, with construction starting mid-2026. With a targeted production capacity of 140 megawatts, the project will generate approximately 15,000 metric tons of green hydrogen annually, replacing 18% of the refinery’s current fossil-derived hydrogen, according to OMV’s official press release dated November 11, 2025. This initiative aligns with the EU’s 2030 target for green hydrogen while positioning Austria at the forefront of Central European renewable energy developments (Source: OMV, Reuters).

Why Europe’s Energy Sector Is Rallying Around Hydrogen Investments

The OMV Masdar green hydrogen Austria investment signals accelerating momentum for the European hydrogen sector. In 2024, the EU reported over €10 billion invested in hydrogen infrastructure, with the RePowerEU plan targeting 10 million metric tons of green hydrogen production by 2030 (European Commission). Austria’s renewable push complements a broader pipeline: Germany’s €900 million H2Global auction program and France’s €7 billion hydrogen strategy, both rolled out in 2022 and 2023, respectively. According to BloombergNEF, green hydrogen project announcements across Europe have surged by 42% year-over-year since 2022, underlining strong institutional backing and policy support.

How Investors Can Capitalize on Austria’s Hydrogen Mega-Project

Institutional and retail investors eyeing opportunities in the hydrogen sector may find renewed impetus in the OMV Masdar joint venture. Shares of OMV AG ($OMV.VI) rose 2.8% to €48.60 in Vienna trading following the announcement, reflecting robust market confidence. Meanwhile, European clean energy ETFs, such as the iShares Hydrogen Economy UCITS ETF (HYDE), gained 1.9% intraday. Hydrogen supply chain companies—ranging from electrolyzer manufacturers like Nel ASA ($NEL.OL) to industrial gas providers—are likely to benefit from increased regional demand. Investors seeking broader exposure may consider clean energy indices or thematic funds, though volatility remains elevated as projects still face execution, regulatory, and cost inflation risks. For the latest sector allocations and risk assessments, visit ThinkInvest’s stock market analysis and latest financial news sections.

What Analysts Expect for the Green Hydrogen Market in 2026

Industry analysts at HSBC and Bernstein Research observe that the OMV Masdar JV may accelerate cost reduction and supply chain maturity in Central European hydrogen markets. Market consensus suggests that reaching scale in Austria could drive regional electrolyzer costs down by 15–20% by 2028 and spur similar partnerships elsewhere. However, experts caution that permitting delays and grid integration challenges could temper near-term ramp-up. The deal exemplifies the growing demand for investable renewable energy infrastructure, with attention turning to regulatory reforms and long-term offtake contracts.

Austria’s Green Hydrogen JV Signals New Era for Energy Investors in 2025

The OMV Masdar green hydrogen Austria venture demonstrates how accelerated project timelines and growing international partnerships are transforming Europe’s clean energy landscape. Investors should track upcoming permitting milestones, further policy developments, and hydrogen offtake agreements as leading indicators for sector momentum. Watch for the OMV Masdar green hydrogen Austria project to become a key benchmark for Central European energy investment strategies through 2027 and beyond.

Tags: OMV, Masdar, green hydrogen, Austria, energy sector