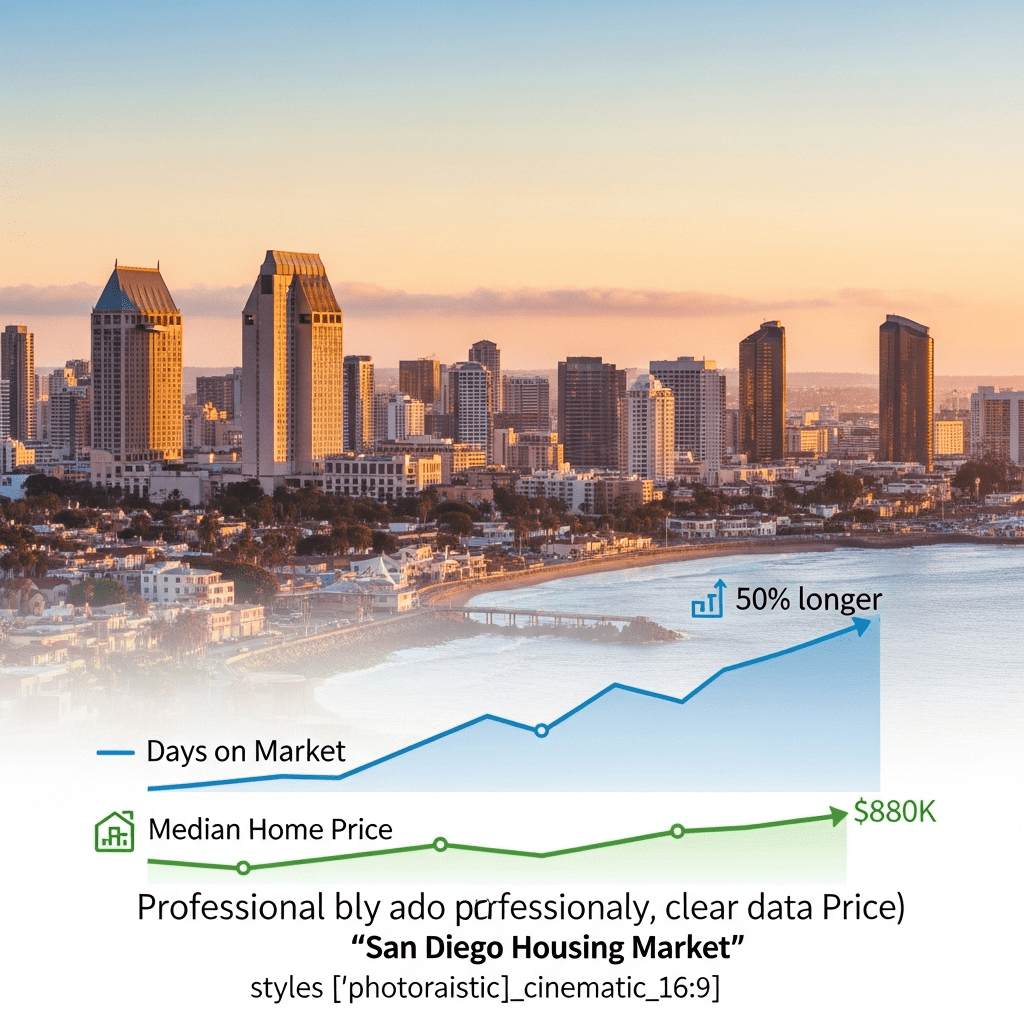

San Diego real estate sellers ($SDHOMES) retained high listing prices as residential properties lingered on the market 50% longer than the previous year, data from October 2025 shows. The persistent strength of listing prices—even amid slowing sales—raises critical questions for both buyers and investors about the region’s housing resilience.

San Diego Listings Take 50% Longer but Prices Remain Resilient

Housing inventory in San Diego County now averages 45 days on market, a sharp jump from 30 days just a year ago, according to Redfin data as of October 2025. Despite this slowdown, median home prices have remained largely static, dipping just 0.8% to $880,000 compared with $887,000 last October. Seller price reductions affected only 19% of all listings, down from 23% in late 2024, based on Zillow’s October local market report. As a result, the expected seasonal cooling has not translated to widespread deals for buyers, underscoring a notable standoff between buyer caution and seller resolve.

How Stubborn San Diego Home Prices Reflect Broader Housing Trends

San Diego’s pricing standoff mirrors tight inventory trends across California and much of the U.S. West, where mortgage rate volatility continues to weigh on both buyers and sellers. Nationwide, the median listing price fell just 1.2% year-over-year in October 2025, per National Association of Realtors (NAR), supporting sellers’ confidence in holding prices. However, total transactions in San Diego County fell 12.5% from a year prior, reflecting persistent affordability challenges as 30-year fixed mortgage rates hover near 7.2%, according to Freddie Mac. This tug-of-war—limited supply amid high financing costs—mirrors conditions discussed in recent financial news coverage of U.S. housing markets.

Investor Strategies as San Diego’s Housing Market Slows

For real estate investors, strategies must adapt to longer listing times and resilient asking prices. Flippers relying on quick resales may see compressed profit margins, while rental property owners could benefit from tighter inventory and high rents—San Diego’s average rent has risen 4.1% to $3,220 year-over-year, per Zumper’s Q3 report. Cautious buy-and-hold investors might gain from waiting out potential winter price softening, but risk missing opportunities if inventory tightens further. Investors tracking California real estate trends should monitor investment strategy shifts and keep abreast of broader stock market dynamics that may impact housing sentiment. Uncertainty around Federal Reserve policy and potential for rate cuts in 2026 could further sway investment decisions in coming quarters.

What Analysts Expect Next for San Diego Real Estate Prices

Industry analysts observe that San Diego home prices are unlikely to see a major correction unless inventory rises or mortgage rates fall meaningfully. Market consensus suggests sellers will continue holding firm on pricing, especially in desirable coastal neighborhoods with ultra-low supply. According to CoreLogic’s September 2025 report, projected income growth in Southern California and ongoing population inflows should support home values despite short-term sales softness.

San Diego Sellers Hold Firm on Pricing as 2026 Outlook Emerges

This year’s standoff, with San Diego sellers holding firm on pricing even as homes linger longer, signals a maturing phase in the local real estate cycle. Heading into early 2026, watch for shifts in mortgage rates and inventory as early catalysts that could reset the dynamic. For investors, the data-driven takeaway is clear: disciplined patience and close tracking of market signals remain essential strategies in this market.

Tags: San Diego, real estate, home prices, housing market, inventory