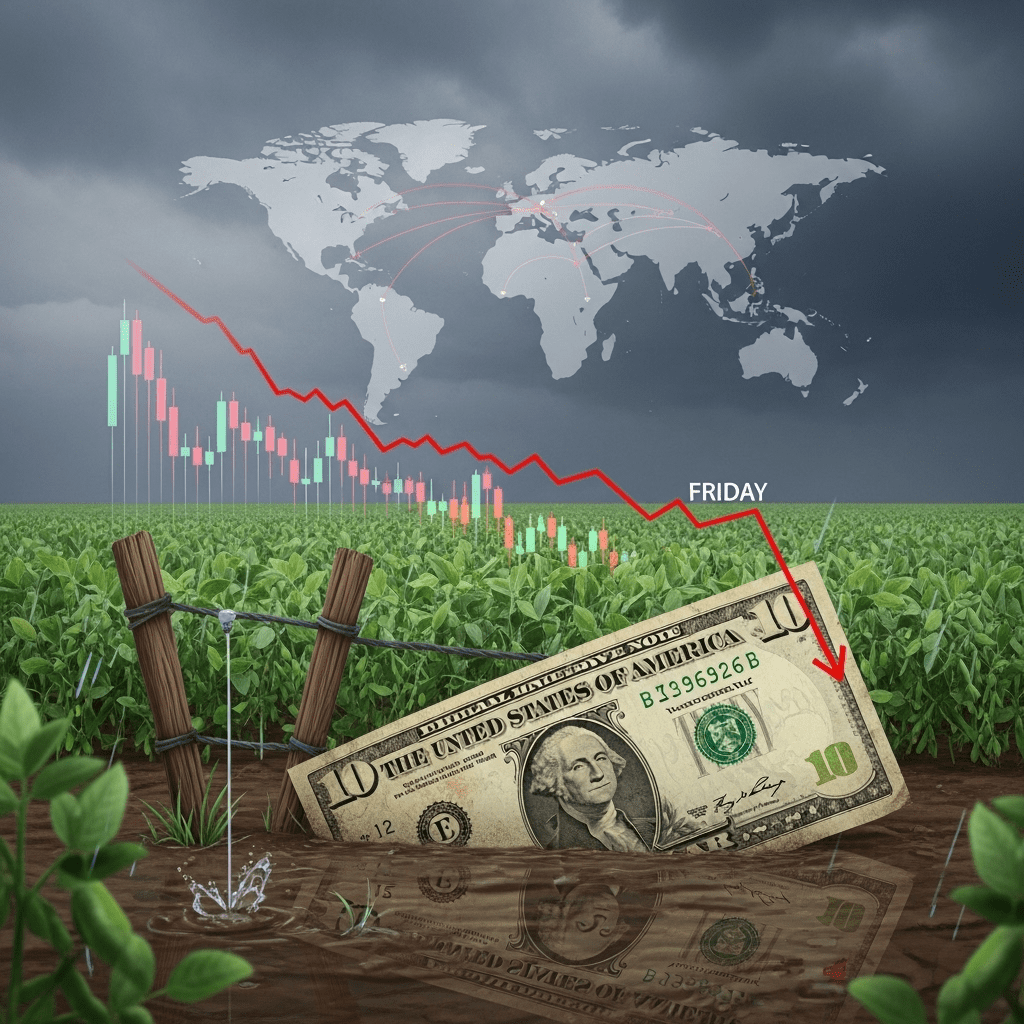

Strong volatility marked agricultural markets this week as soybeans hold $10 but fall on Friday as trade tensions rise. Investors, analysts, and producers alike kept a close watch on the commodity’s resilience despite mounting pressure from escalating geopolitical uncertainties and shifting trade flows. This tumultuous movement underscores the ongoing sensitivity of soybean prices to international developments, and highlights the wider impact on the stock market and agricultural investments.

Soybeans Hold $10 but Fall on Friday as Trade Tensions Rise: Market Update

Soybean futures demonstrated relative strength early this week, maintaining a critical support level at $10 per bushel on the Chicago Board of Trade. However, as the week drew to a close, renewed concerns over trade tensions between major economies triggered a downward move on Friday. The primary drivers included fresh tariff threats, policy statements, and weaker export outlooks for U.S. crops, reigniting fears of retaliation from key buyers such as China and the European Union.

This ripple effect saw traders reposition and hedge, leading to an end-of-week decline that contrasted with the earlier optimism. According to analysts, the $10 mark is a psychological and financial threshold, with breakouts below this potentially signaling further selling pressure in coming sessions. For investors tracking commodity trends, the performance of soybeans provides a crucial indicator for broader risk appetite and market sentiment across agribusiness stocks.

Trade Tensions: The Primary Catalyst Behind Price Moves

The persistent trade disputes have weighed heavily on soybean futures throughout 2025, mirroring similar episodes from past years. Several rounds of negotiations, counter-tariffs, and policy changes between the U.S. and its trading partners have fueled uncertainty. With each announcement or rumor, speculative trading activity spikes, making the markets prone to sudden reversals.

On Friday, the announcement of potential new tariffs on U.S. agricultural imports instigated a broad market reassessment. Large futures holders pared down positions, amplifying the price slide and erasing earlier weekly gains. This pattern has repeated throughout recent years, highlighting the importance of staying updated with reliable market analysis and understanding the real-time relationship between politics and commodity pricing.

Global Supply Chain and Export Implications

Beyond immediate price reactions, the ongoing tensions present complex challenges for the global supply chain. As the U.S. faces hurdles in exporting to traditional partners, other major soybean producers such as Brazil and Argentina stand to gain market share. This growing competition puts further pressure on American farmers and exporters, many of whom are already adapting to shifting demand.

Volatility in the soybean market also impacts related industries, from transportation and logistics to consumer products that rely on stable agricultural prices. For those seeking diversified investment strategies, these interconnected trends offer both risks and opportunities as the market recalibrates.

Investor Outlook Amidst Lingering Uncertainty

With soybeans holding the $10 line but remaining vulnerable to fresh declines, investors are balancing caution with tactical opportunity. Technical analysts point to key support and resistance levels, the influence of macroeconomic data, and the potential for significant swings if new trade agreements or disputes emerge. The U.S. dollar’s performance, weather patterns, and global consumption trends will all shape price direction in the coming quarters.

What to Watch Moving Forward

Market participants are urged to monitor not only the next round of trade talks but also updates on crop conditions, export sales numbers, and policy developments. In the broader context of the stock market, movements in the soybean complex may serve as a barometer for risk aversion or appetite, influencing related equities and ETF performance.

As always, prudent diversification and ongoing education are critical, with many turning to trusted sources for breaking news and deep-dive analysis. By understanding how soybeans hold $10 but fall on Friday as trade tensions rise, investors can better navigate the uncertainties ahead and position themselves for resilience in volatile agricultural markets.