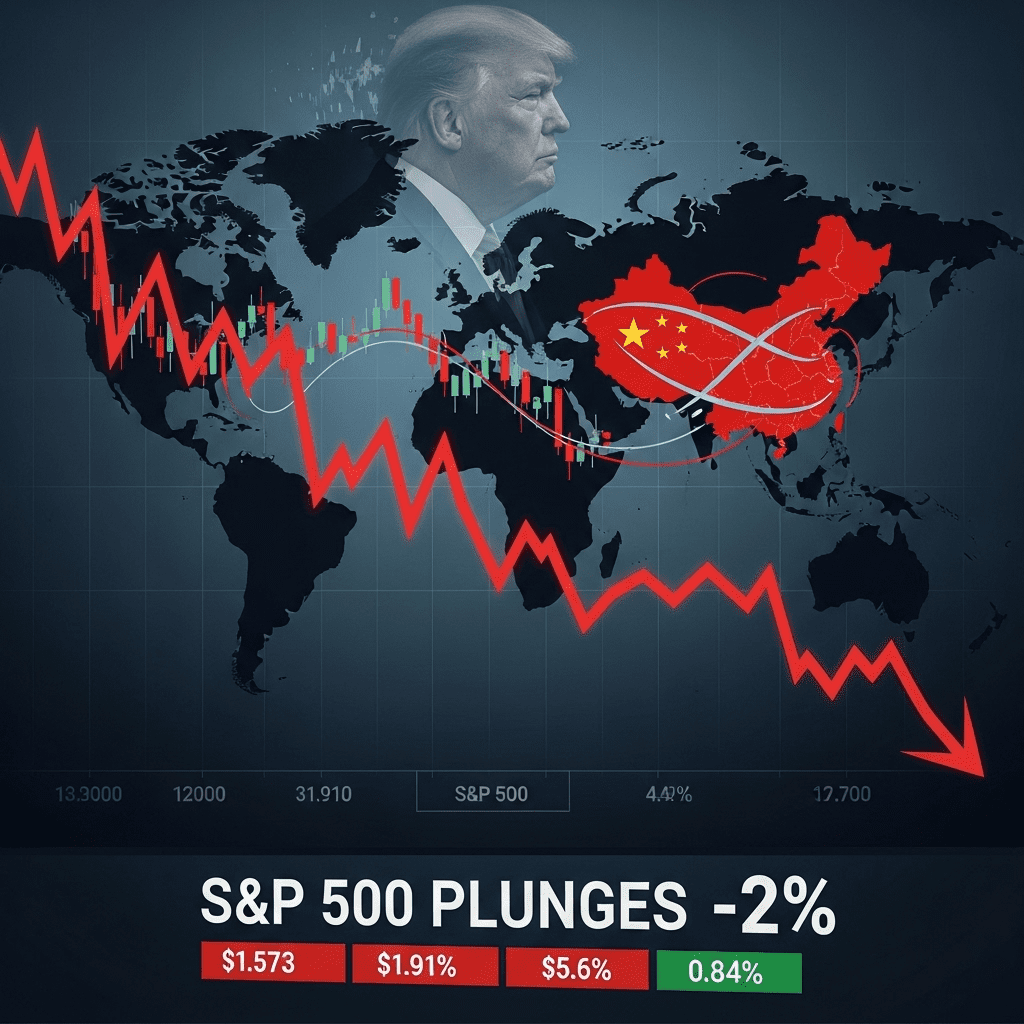

The S&P 500 gains and losses today have drawn intense attention, as the index recorded a significant plunge following former President Donald Trump’s renewed threats to impose higher tariffs on Chinese imports. This sudden policy proposal sent ripples through global markets, raising concerns among investors about the renewed escalation of U.S.–China trade tensions.

S&P 500 Gains and Losses Today: Market Reaction to Trump’s Tariff Threat

Amid fast-moving headlines, the S&P 500 shed more than 2% in early trading, reflecting widespread unease after Trump’s public threat to substantially hike tariffs on a wide range of Chinese goods if re-elected. The focus on S&P 500 gains and losses today underscores how sensitive equity markets remain to geopolitical uncertainty, particularly when it comes to trade relations between the world’s two largest economies.

Sector performance varied, with heavy losses noted in technology, industrials, and consumer discretionary stocks—industries most exposed to global supply chains and tariffs. Mega-cap companies such as Apple, Caterpillar, and Nike saw their shares fall sharply, while more domestically focused sectors like utilities showed relative resilience.

Underlying Causes of Market Volatility

Investors are keenly aware that tariff increases can push up costs for American consumers and businesses, threaten corporate profit margins, and ultimately dampen economic growth. Trump’s latest comments revived memories of the trade war turbulence experienced in previous years—episodes that resulted in heightened volatility and significant market drawdowns for the S&P 500.

Volatility indexes spiked to their highest levels in months, as traders rushed to hedge portfolios against further declines. As a result, safe-haven assets such as Treasury bonds and gold saw increased inflows, reflecting a classic risk-off rotation.

Historical Context and Current Risks

The latest market updates highlight that while the S&P 500 has generally shown resilience after political shocks, prolonged uncertainty around trade policies tends to weigh on both corporate sentiment and capital expenditure. Analysts warn that renewed tariffs on China could disrupt supply chains, increase input prices, and ultimately reduce S&P 500 companies’ earnings.

Beyond equities, currency markets also shifted markedly, with the yuan weakening against the dollar, further pressuring companies with cross-border operations or significant revenue from China. This multi-asset response emphasizes how broad and interconnected the impact of such policy threats can be.

How S&P 500 Gains and Losses Today Affect Investor Portfolios

Active and passive investors alike are now reassessing portfolio exposures to sectors and companies most vulnerable to trade tensions. Portfolio managers recommend maintaining diversification and hedging strategies, especially in the face of unpredictable political events.

Financial advisors at ThinkInvest suggest that while reacting to short-term swings is tempting, maintaining a long-term perspective remains critical. Tactical adjustments in allocation may be warranted, but wholesale changes based on daily moves could introduce unnecessary risk.

Expert Insights and Strategic Outlook

Despite the sell-off, long-term fundamentals for the S&P 500 remain intact, barring a full re-escalation of the trade war. Corporate earnings growth, robust consumer demand, and sustained innovation in technology and healthcare underpin the index’s performance. That said, investors should stay informed on evolving news and consider enhancing their risk management processes. Monitoring macroeconomic data and staying connected to trusted investment insights is more important than ever.

Looking forward, market participants will monitor both U.S. political rhetoric and any responsive action from Chinese officials. Any signs of conciliatory dialogue could prompt a swift rebound in equities, while further threats or policy implementation may prolong volatility into the months ahead.

Conclusion: Navigating Turbulence in S&P 500 Gains and Losses Today

Today’s steep decline in the S&P 500 serves as a timely reminder of the market’s vulnerability to political developments and global trade tensions. The focus on S&P 500 gains and losses today highlights the importance of vigilance, portfolio diversification, and strategic planning. Whether this is a short-lived reaction or marks the start of renewed market instability will depend on both political developments and investor sentiment in the coming days. As ever, keeping an eye on both macro events and underlying company fundamentals will be crucial for navigating periods of turbulence.