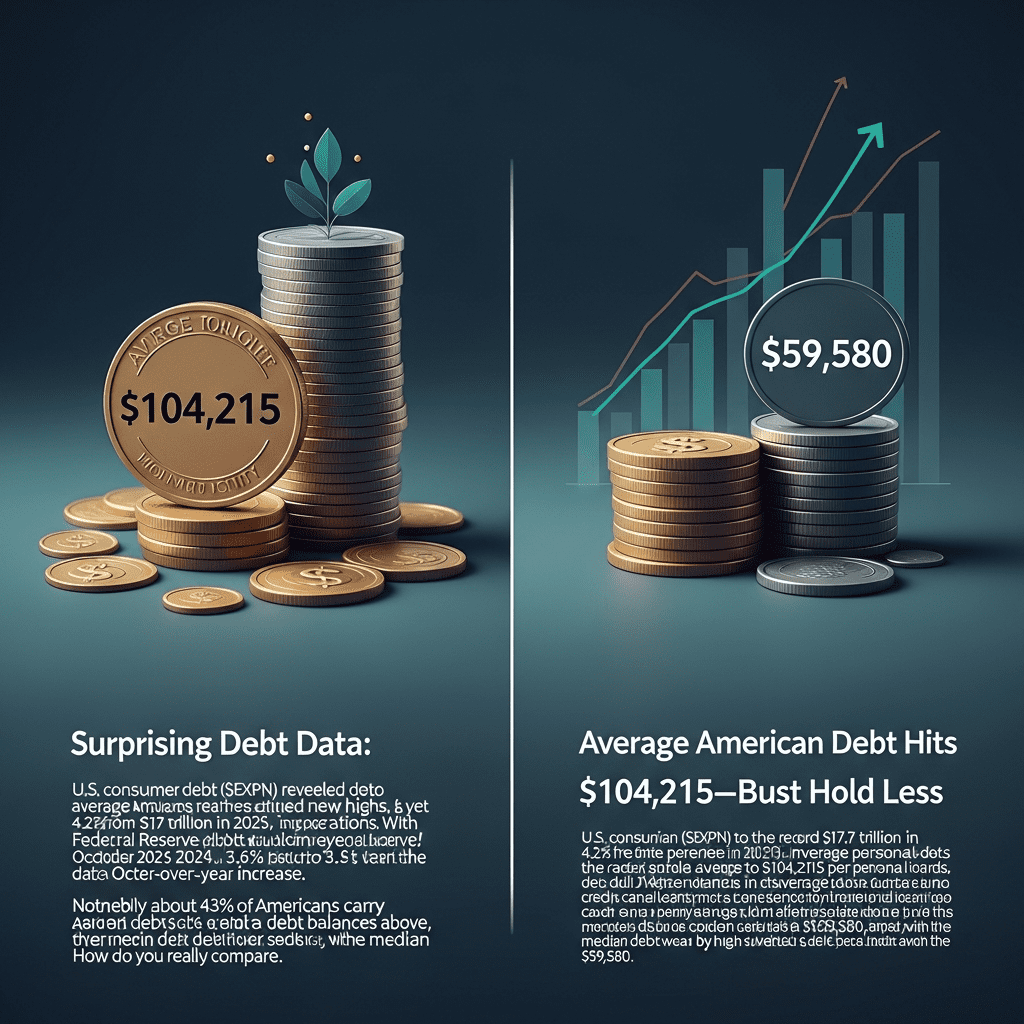

Experian ($EXPN) revealed average American debt 2025 figures reached new highs, yet individual balances often trail expectations. With average total debt at $104,215 per adult, many find their own situation less severe than the headlines suggest. How do you really compare?

Average American Debt Hits $104,215—But Most Hold Less

U.S. consumer debt climbed to a record $17.7 trillion in 2025, up 4.2% from $17 trillion in late 2024, according to Federal Reserve data published in October 2025. Experian ($EXPN) reports the average personal debt—including mortgages, student loans, auto loans, credit cards, and personal loans—rose to $104,215 per adult, a 3.6% year-over-year increase. Notably, only about 43% of Americans carry debt balances above this average, with the median debt load standing significantly lower at $59,580. These numbers highlight the skew created by high-wealth borrowers with large mortgages, distorting the average experience for most Americans (sources: Fed Consumer Credit Report, Experian 2025 State of Credit).

How Debt Trends Impact the Broader U.S. Economy in 2025

Rising debt levels signal both confidence in the economy and pressure on household finances. Credit card balances topped $1.24 trillion, a 7.1% jump from 2024, as consumers relied on revolving credit to counter inflation, per the New York Feds Q3 2025 report. Delinquency rates for auto loans increased from 5.6% in 2024 to 6.2% in September 2025—a level last seen in 2011. Mortgage debt remains the largest segment, now at $12.93 trillion. This mix of growing debt and rising delinquencies feeds into wider concerns about lending standards, consumer spending, and macroeconomic stability, which investors can monitor through regular updates on latest financial news.

Strategies for Investors Navigating Changing American Debt Levels

Investors may find opportunity and risk in shifting debt trends. Sectors tied to consumer credit—like regional banks and credit card issuers—face headwinds as delinquencies rise. Financials such as JPMorgan Chase ($JPM) and Discover Financial Services ($DFS) have adjusted lending criteria in response to these pressures. Long-term investors might consider steady dividend payers within the financial sector, while those focused on volatility could monitor debt-driven companies for potential credit downgrades or asset repricing. Staying informed through stock market analysis and investment strategy updates can provide timely insights into portfolio positioning during this evolving debt cycle.

Analysts Anticipate Uneven Debt Resolution Through 2026

Market strategists note consumers are prioritizing mortgage and auto payments while letting revolving balances grow. According to analysts at Wells Fargo and Moodys Analytics (Q3 2025 outlooks), household finances remain resilient overall, but significant segments face mounting debt-servicing strain. Market consensus suggests further debt growth will slow if interest rates hold steady or decline, as forecast by many economists in late 2025.

Where Average American Debt 2025 Trends Point Investors Next

As the average American debt 2025 figure climbs, the gap between average and median debt shows most people carry substantially less than headline numbers. Investors should watch shifts in delinquency data and consumer credit trends, as these developments could signal upcoming moves in financial stocks and consumer discretionary sectors. Monitoring individual debt levels in context is key for both personal benchmarking and broader investment decisions.

Tags: average American debt 2025, consumer credit, $EXPN, financial news, stock market analysis