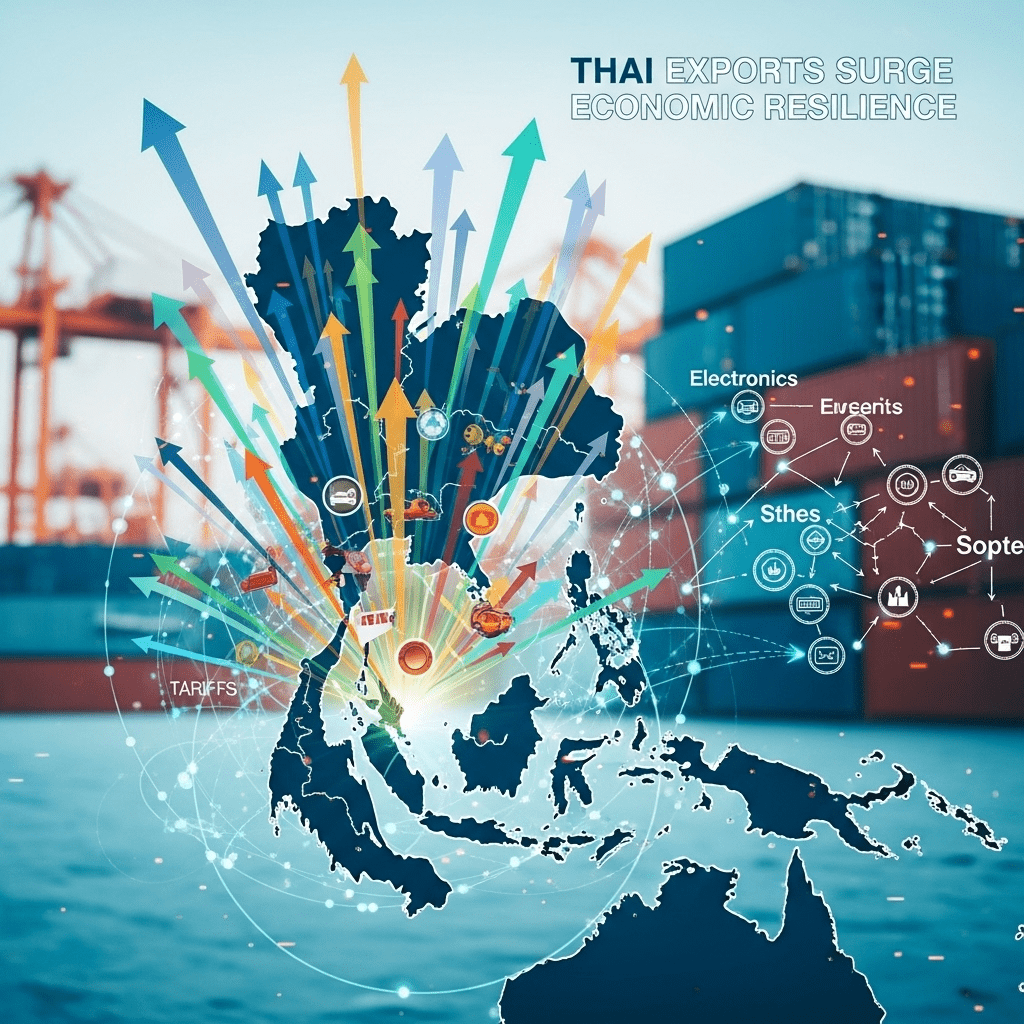

What Happened

Thai exports jumped 19% year-over-year in the first five months of 2025, far outpacing consensus estimates of 12% growth, despite the imposition of expanded U.S. tariffs under the renewed Trump administration. According to official data released by Thailand’s Ministry of Commerce and confirmed by Reuters on June 12, 2025, the total export value reached $126.4 billion, with electronics, automotive parts, and agricultural goods leading the gains. “The export sector has adapted rapidly to geopolitical changes, diversifying into new markets and high-value industries,” Commerce Minister Pimchanok Sricharoen told Bloomberg. Exports to ASEAN and the EU offset reduced shipments to North America, highlighting a successful pivot in trade strategy amid global tensions.

Why It Matters

The robust growth in Thai exports, despite increased trade barriers, illustrates the economy’s agility in the face of shifting global dynamics. Recent years have seen many Southeast Asian economies grappling with protectionist policies from key partners. According to recent market analysis, the 2025 U.S. tariff hikes—particularly targeting automotive components and electronics—were expected to dampen Thai shipment volumes. However, Thailand’s ability to sustain double-digit growth contrasts with 2023, when export volumes contracted amid global supply chain disruptions. This development highlights Southeast Asia’s broader role as a trade alternative amid ongoing U.S.-China tensions, offering a data point for institutional investors tracking emerging market resilience.

Impact on Investors

For investors, Thailand’s 19% export surge suggests resilient growth opportunities across manufacturing, supply chain, and regional logistics sectors. Publicly traded names on the Stock Exchange of Thailand (SET), such as Delta Electronics (SET: DELTA), Thai Union Group (SET: TU), and Minor International (SET: MINT), saw renewed interest following the release of trade figures. “The data signal a competitive advantage for Thai exporters able to adapt supply chains and reach alternative markets,” said Virote Sato, Asia-Pacific Equity Strategist at J.P. Morgan, citing upside revisions to 2025 GDP forecasts. However, elevated input costs and ongoing uncertainty around U.S. trade policy pose risks. Investors are advised to monitor U.S. tariff developments and ASEAN integration trends, as detailed in recent investment insights.

Expert Take

Analysts note that Thailand’s swift adjustment to tariff headwinds underscores the importance of regional trade networks and supply chain agility. Market strategists suggest investors evaluate exposure to Southeast Asian manufacturers benefiting from shifting global demand patterns—a theme covered in ThinkInvest’s global trends commentary.

The Bottom Line

Thailand’s 19% export jump in 2025 surprised markets, reflecting the country’s economic adaptability and capacity to capture new trading partnerships even amid high-profile U.S. tariff actions. For investors, the strong trade data reinforce the region’s strength as a supply chain hub and a focal point for emerging market allocation as global trade evolves. Tracking “Thai exports jump 19%” will remain essential for informed portfolio positioning in the coming quarters.

Tags: Thai exports, 2025 tariffs, emerging markets, Southeast Asia trade, supply chain resilience.