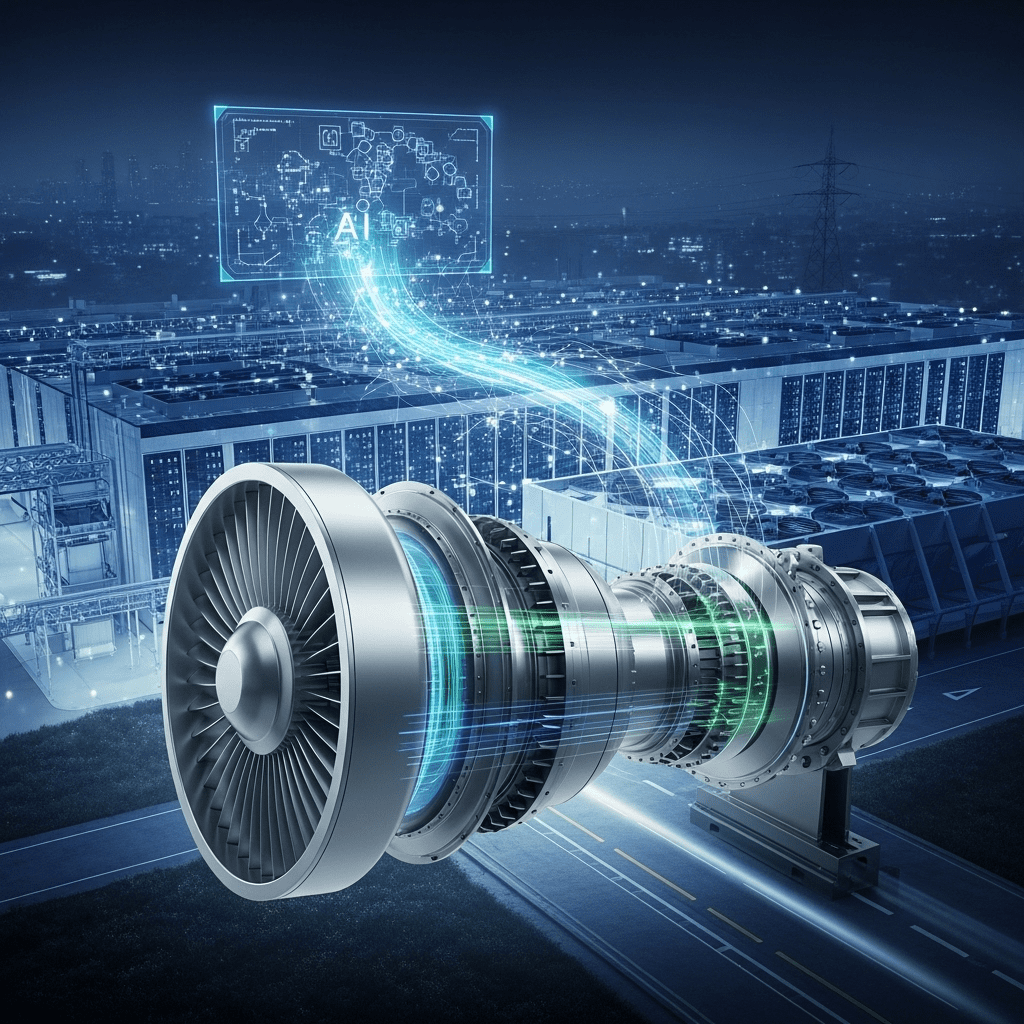

The AI race sparks unprecedented demand for gas turbines as technology giants, data centers, and energy firms rush to meet soaring power needs in 2025. With artificial intelligence systems driving a new era of computing, pressure is mounting on the global energy sector to deliver reliable, scalable, and low-carbon electricity at an extraordinary pace.

Why the AI Race Sparks Unprecedented Demand for Gas Turbines

Artificial intelligence, especially generative AI models, has triggered a critical shift in electricity consumption patterns. Unlike traditional cloud computing, AI training and real-time inference require enormous and consistent power loads. As major data centers expand capacity to fuel these compute-intensive processes, gas turbines are emerging as a linchpin technology for bridging the gap between renewable energy supply and skyrocketing demand.

Historically, gas turbines served as flexible, quick-ramping backup solutions for intermittent solar and wind power. In 2025, however, they are increasingly deployed as core components of new and upgraded power generation plants. According to industry research from BloombergNEF, orders for industrial gas turbines jumped by over 30% in the past 12 months, led by North American and Asian markets where AI-led data center expansion is most intense.

Data Centers and the AI Surge: A Perfect Storm for Power Demand

Tech titans such as Microsoft, Google, and Amazon Web Services are at the forefront of this energy transformation. Their hyperscale data centers are projected to consume nearly 10% of global electricity production by 2030, up from 3% in 2020. This exponential increase is directly linked with AI’s hunger for high-performance computing hardware and always-on operations.

Many operators are investing billions in on-site or nearby gas turbine installations to secure energy resilience and uptime. With renewable generation still subject to weather variability, gas turbines provide the crucial backup that enables uninterrupted AI services—a necessity for both competitiveness and compliance in tech infrastructure markets. As a result, suppliers like General Electric, Siemens Energy, and Mitsubishi Power are scaling up production and innovating with hydrogen-ready and low-emission turbine models.

Investment Opportunities as AI Race Sparks Unprecedented Demand for Gas Turbines

These seismic changes in energy infrastructure present intriguing opportunities for forward-thinking investors. Turbine manufacturers, as well as natural gas utilities and pipeline operators, are seeing surging demand and improving margins. In parallel, the integration of gas turbines with carbon capture technology is emerging as a critical pathway for curbing emissions and aligning with ESG mandates.

Investors seeking exposure to this trend may consider the growing universe of energy transition ETFs, individual turbine makers, or even infrastructure funds targeting long-term growth markets. However, the long-term trajectory will depend on regulatory frameworks, pricing of carbon emissions, and continued advances in battery storage and green hydrogen for decarbonization.

The Global Picture: Policy and Supply Chain Considerations

The surge in demand is not without challenges. Supply chain bottlenecks—especially for turbine components and critical metals—could constrain deployment timelines. Policymakers in the U.S., EU, and Asia are weighing incentives for domestically produced turbines and investments in grid modernization. Meanwhile, LNG exporters and pipeline developers are adjusting to more dynamic load patterns and increased scrutiny of methane emissions.

For energy portfolio managers and analysts, following these evolving policy frameworks is essential. Consult energy market analysis to stay ahead of regulatory shifts that could impact returns or project viability. In volatile markets, risk management and scenario planning will be more important than ever as gas turbines play a dual role in both energy security and sustainable transition.

How the AI Race Sparks Unprecedented Demand for Gas Turbines: The Road Ahead

Looking forward, the AI-fueled boom in gas turbines is expected to persist for at least the next five years, with further innovations anticipated. Advanced turbines capable of integrating with low-carbon fuels such as hydrogen, and retrofitting for carbon capture, will be priorities for both utilities and tech firms chasing net-zero targets.

For financial professionals, staying informed about these trends through credible sources—such as investment insights—is key to capitalizing on the overlap between AI, energy, and sustainable returns. As the boundaries between technology, infrastructure, and capital allocation continue to blur, those prepared to anticipate demand and regulatory response will be best positioned for success.