What Happened

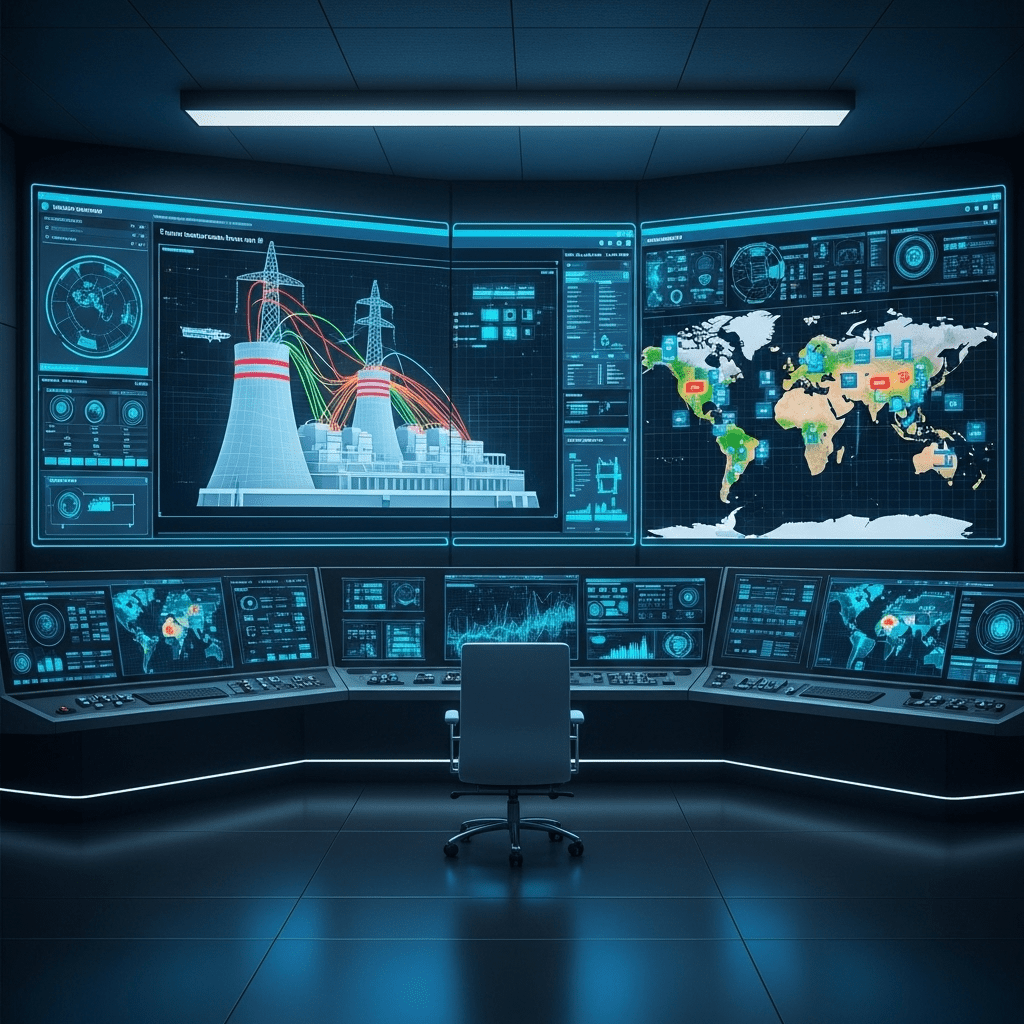

In early 2025, leading utility companies across North America, Europe, and Asia announced wide-scale rollout of autonomous operation and remote control centres for both new and existing power plants. According to a recent Bloomberg report, over 120 power generation facilities globally—spanning natural gas, renewables, and nuclear sectors—have integrated AI-driven systems capable of real-time monitoring, predictive maintenance, and fully remote grid balancing. Siemens Energy, a major player in this development, disclosed that its autonomous platforms can cut operational staffing by up to 60%, with an estimated operational cost reduction of 20%. “The ability to remotely oversee complex operations while minimizing human intervention marks a seismic shift for the industry,” said Maria Zimmer, CTO at Siemens Energy (Bloomberg, Jan. 2025).

Why It Matters

This transformation is significant amid the global drive for decarbonization and energy security. Automated control centres improve system reliability, mitigate risks of labor shortages, and optimize energy dispatch—all critical in volatile markets. Data from the International Energy Agency (IEA) indicates that digital technologies in power operations could save $80 billion annually in global generation costs by 2030. Historical comparisons show that similar digital leaps—in telecom and logistics—spurred rapid sectoral consolidation and efficiency gains, trends likely to repeat in the utility space. Moreover, investment insights suggest utilities that embrace automation early may secure lasting cost advantages and strengthen margins despite rising capital expenditures.

Impact on Investors

For investors, this technology shift alters risk-reward calculations across the energy sector. Leading utility tickers like NEE (NextEra Energy), DUK (Duke Energy), and ENGIY (Engie SA) stand to benefit from improved operational leverage and capital allocation flexibility. However, automation may spark workforce realignment and upfront technology costs. “Investors need to balance near-term integration risks against long-term value creation from autonomous systems,” observes Priya Tan, Head of Utilities Research at J.P. Morgan. Sectors adjacent to energy—such as industrial automation and cybersecurity—are likely to see boosted demand. For financial market participants monitoring market analysis, the evolution toward AI-driven energy management could impact valuation multiples, M&A activity, and dividend stability in the utility sector.

Expert Take

Analysts note that utility providers leading the adoption of autonomous control centres are positioned to outperform peers as cost efficiency and asset uptime become competitive differentiators. Market strategists suggest the pace of global rollout will depend on regulatory buy-in, data privacy standards, and the speed of legacy grid modernization.

The Bottom Line

The integration of autonomous operation and remote control centres marks a watershed moment for the future of power plants, with sustained impacts on efficiency, resilience, and sector profitability. As these AI-driven systems become industry standard, discerning investors will continue to seek strategic opportunities across the evolving energy value chain.

Tags: autonomous power plants, energy innovation, remote control centres, AI in utilities, energy investment.