In 2025, policymakers worldwide grapple with the hard task of exiting the populist trap, facing mounting economic consequences and strategic dilemmas. Understanding the intricacies of this challenge is essential for investors and economists seeking to navigate today’s volatile environment.

The Hard Task of Exiting the Populist Trap: Economic Repercussions

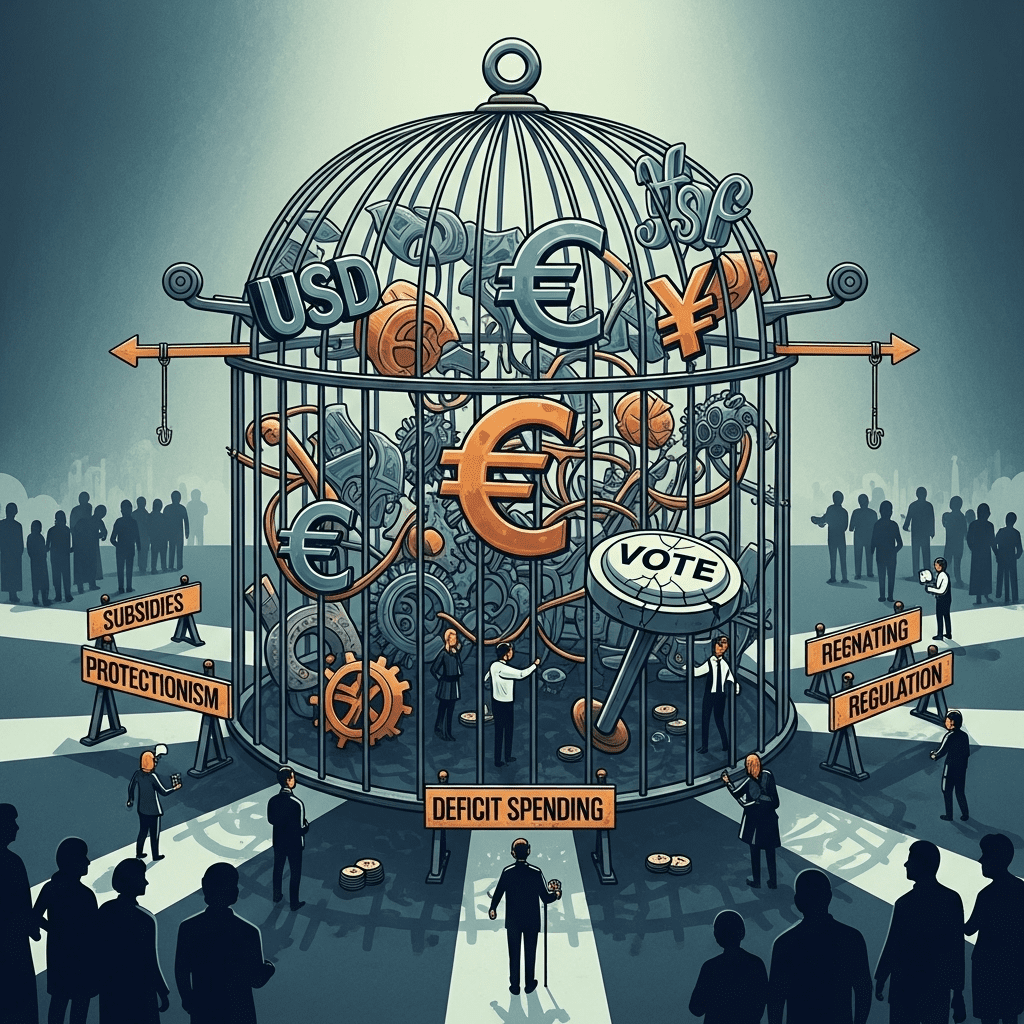

Exiting the populist trap is not merely a political quandary; it poses deep economic ramifications. Over recent years, populist policies—often characterized by expansionary fiscal spending, trade protectionism, and regulatory backlash—have altered economic fundamentals in key global markets. As voters demand short-term gains, governments tend to deploy policies that please the majority but can sideline fiscal discipline and undermine investor confidence.

When the time comes to unwind such policies, leaders confront both political resistance and serious economic headwinds. For example, scaling back on subsidies or reversing deficit spending frequently induces social unrest and can create fiscal shocks. Such challenges are particularly acute in emerging markets, but advanced economies, too, have not been immune. The cycle often creates a feedback loop: populist measures beget economic distortion, which leads to discontent and, in turn, fuels more populism.

Investment Risks and Market Reactions

For investors, the unpredictability of exiting the populist trap elevates market risks. Credit rating agencies often respond strongly to the abandonment of fiscal discipline, as witnessed in country downgrades from 2022–2024. Volatile currency fluctuations and bond spreads remain critical concerns as policymakers attempt to normalize conditions. Investors are turning to trusted investment insights to navigate risks associated with sovereign debt, inflationary surges, and shifting regulatory climates.

Global Lessons from Attempting to Exit the Populist Trap

Historical precedents demonstrate the enduring difficulty of unwinding populist policies. In Latin America, Argentina’s repeated swings between market-friendly reform and populist retrenchment illustrate the cycle’s persistence. The European Union offers another perspective: countries like Italy and Hungary have wavered between encouraging business investment and succumbing to populist demands for subsidies or pension expansions.

These case studies provide cautionary tales for investors. As nations try to exit populist traps, the transition path determines whether stability or further upheaval follows. A careful balance of communication, gradual policy shifts, and international support often proves essential for success. In this context, global investors rely heavily on financial analysis platforms to track policy developments and market sentiment shifts.

Policy Strategies for Breaking the Cycle

Experts suggest several policy approaches to easing the transition. Fiscal transparency and clear communication are fundamental; when governments articulate credible plans, they mitigate uncertainty and temper public backlash. Phased reforms, such as gradually reducing subsidies while expanding targeted welfare, can soften economic shocks. Engagement with international institutions, including the IMF, may provide credibility and necessary support.

However, a mismanaged exit may cause more harm than good, manifesting as social unrest, capital flight, and increased risk premiums. As the global economic recovery advances in 2025, successful navigation of the populist trap will likely differentiate robust markets from fragile ones, with forward-thinking investors closely monitoring these developments for emerging market opportunities.

Navigating Uncertainty: The Investor’s Perspective on Exiting the Populist Trap

For long-term wealth managers and portfolio strategists, the uncertainty surrounding countries attempting to exit the populist trap cannot be overstated. Understanding both the timing and nature of such policy shifts is crucial—and potential missteps can upend investment theses overnight. Analysts urge diversification and a preference for markets with demonstrated institutional resilience. Tracking real-time data, local political developments, and cross-border capital flows offers critical signals in adapting strategies.

Conclusion: Looking Ahead in 2025

The hard task of exiting the populist trap will remain central to economic narratives worldwide throughout 2025. The path forward requires deft policymaking, transparent communication, and a pragmatic yet flexible approach to reform. Investors and economists who stay informed of policy signals, leverage robust data, and seek out authoritative investment insights will be best positioned to navigate the next phase of a rapidly changing global market.