What Happened

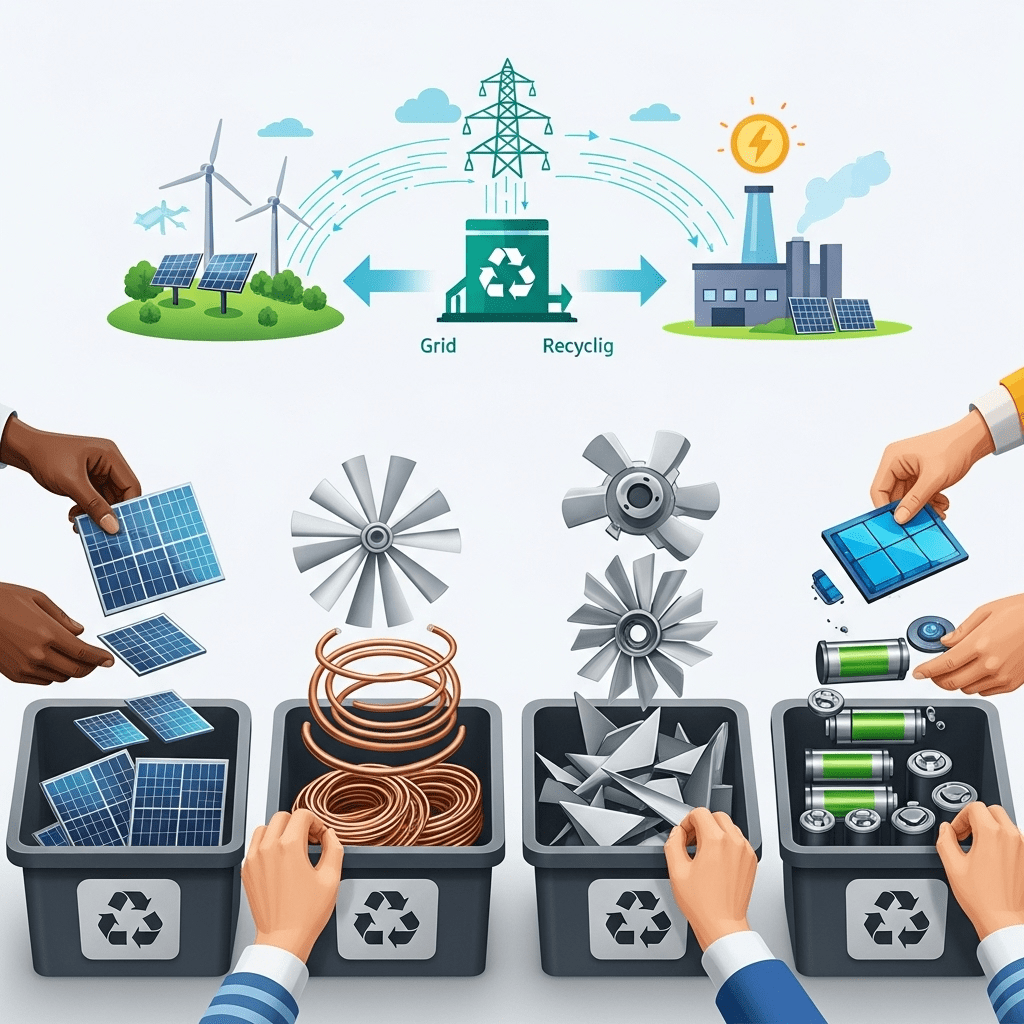

The race to recycle renewable energy ramped up in the first half of 2025 as governments, utilities, and private capital converged to address the mounting waste from the world’s green energy boom. According to BloombergNEF, global solar panel installations are on track to exceed 500 GW this year, with projections that over 8 million metric tons of obsolete solar panels could enter the waste stream annually by 2030. The International Renewable Energy Agency (IRENA) estimates end-of-life wind turbine blades will add an additional 40 million tons of composite waste by 2050. In response, several leading energy firms—such as NextEra Energy (NYSE: NEE) and Siemens Gamesa (BME: SGRE)—have accelerated recycling joint ventures and pilot programs. “We view circular supply chains as a core part of our sustainable growth strategy,” noted Siemens Gamesa CEO Jochen Eickholt in a recent press statement.

Why It Matters

As deployment of renewables scales worldwide, the economic and environmental imperative to recycle energy assets is rapidly intensifying. Historically, renewable infrastructure was not designed with circularity in mind, resulting in mounting landfill pressure and critical mineral shortages. Today’s policy shifts—illustrated by the European Union’s new Waste Electrical and Electronic Equipment (WEEE) directive updates and the U.S. Department of Energy’s $95 million Battery Recycling R&D initiative—signal a permanent change. Analysts highlight that robust recycling ecosystems can mitigate raw material bottlenecks, dampen commodity price volatility, and foster localized green manufacturing, reinforcing investor confidence in the sector. The latest market analysis reveals a strong correlation between recycling capabilities and renewable asset valuations.

Impact on Investors

For investors, the surge in renewable recycling activity creates both risk and opportunity. Pure-play recyclers like Li-Cycle Holdings (NYSE: LICY) and Redwood Materials are expanding capacity, while established green energy giants increasingly view recycling as a competitive differentiator. Global green infrastructure ETFs (ICLN, QCLN) have begun allocating to recycling tech providers, reflecting shifting capital flows. Risks remain: costs of recycling for legacy assets often exceed landfill disposal, and regulatory uncertainty could influence future profit pools. “Recycling is quickly becoming table stakes for utility-scale renewables,” says Priya Kumar, sustainable energy strategist at Rystad Energy. “But cost discipline and policy support will separate winners from laggards.” Investors are advised to monitor emerging trends in renewable supply chains and regulatory frameworks regionally.

Expert Take

Analysts note that securing circularity in renewable energy will be ‘absolutely essential’ to scaling clean power profitably post-2025. Market strategists suggest investors focus on companies leading in recycling partnerships and technology as regulatory momentum accelerates.

The Bottom Line

The race to recycle renewable energy is moving from pilot stage to a strategic market driver in 2025, reshaping cost structures, material flows, and investment prospects for the decade ahead. As recycled materials become essential to powering net-zero growth, investors tracking the intersection of regulation, innovation, and execution stand to benefit from early positioning in this emerging theme. For deeper insights, visit our investment insights section.

Tags: renewable energy, recycling, green finance, sustainable investing, clean tech.