The space solar power revolution is well underway, rapidly transforming the future dynamics of global energy production and offering unique opportunities for forward-thinking investors. As the race to decarbonize intensifies, space-based solar power is fast moving from science fiction to a multi-billion dollar reality, reshaping the way the world approaches clean energy and sustainable economic growth.

The Space Solar Power Revolution: 2025 Investment Landscape

Technological breakthroughs, declining launch costs, and increasing demand for renewable energy have put the space solar power revolution firmly on the radar of institutional and retail investors alike. Unlike terrestrial solar farms, space-based systems capture sunlight uninterrupted by weather or atmospheric losses and beam energy directly to Earth, significantly boosting efficiency. In 2025, pioneering projects by agencies like NASA, the European Space Agency, and China’s State Power Investment Corporation have spurred a rush of global partnerships and private sector entrants, unlocking new avenues for investment, growth, and long-term returns.

The Technology Behind Space-Based Solar Power

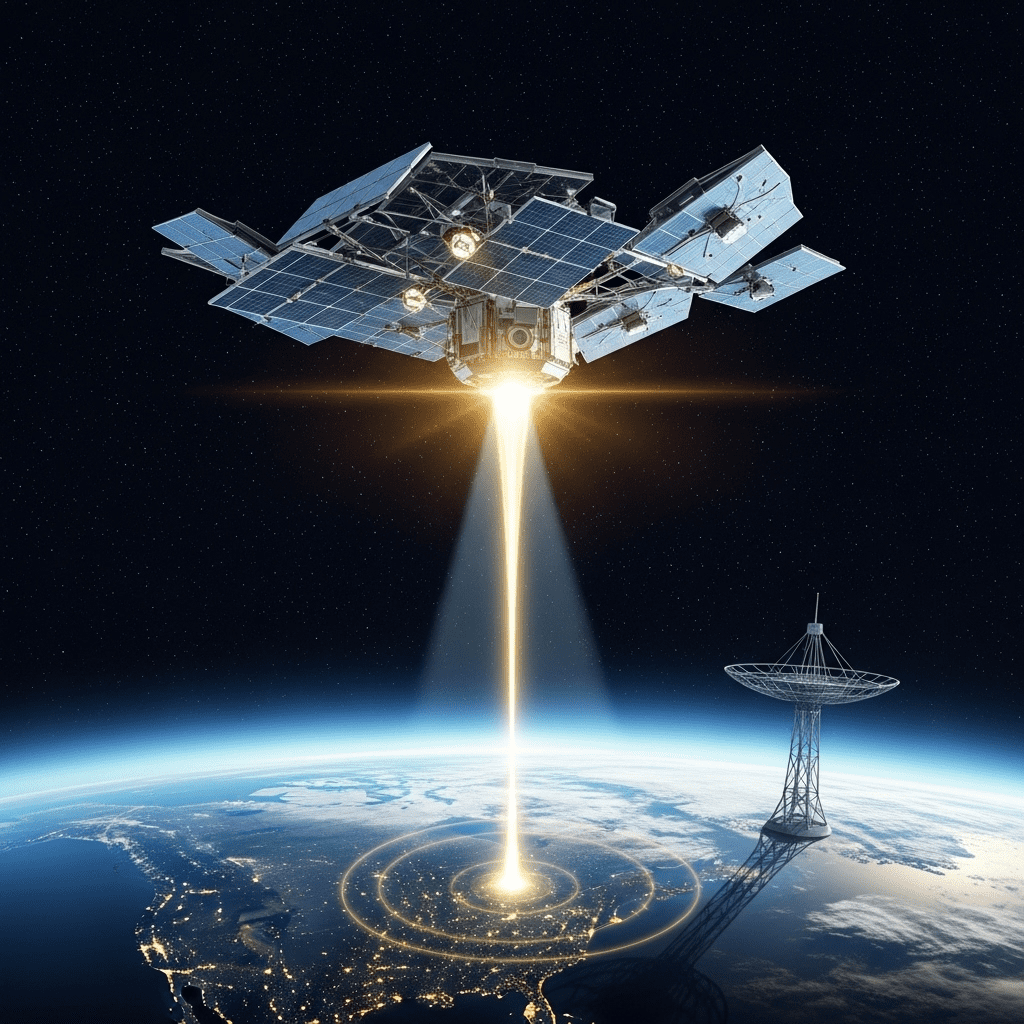

Modern technology innovation in space solar power utilizes advanced photovoltaic panels stationed in geosynchronous orbit. These machines convert sunlight to energy and transmit it wirelessly—via microwaves or lasers—down to receiving stations on Earth. Decades of R&D have addressed many former obstacles, including beam precision, energy loss in transmission, and the size and weight of orbital hardware. In 2025, new composite materials and AI-managed satellite constellations are making large-scale deployment both technically feasible and economically attractive.

Global Economic and Geopolitical Impacts

The space solar power revolution is more than a new renewable technology; it’s a strategic asset reshaping global energy security and international relations. Countries with robust space programs and capital access are racing to secure leadership. For instance, China’s successful 2025 demonstration of a gigawatt-class space solar power station has intensified international competition, sparking new investments and driving policy shifts across the EU, US, and Japan. These developments are poised to impact commodity markets, traditional utilities, and the broader clean energy sector.

Opportunities and Risks in the Space Solar Power Revolution

For investors, the economic potential of the space solar power revolution spans hardware suppliers, wireless transmission firms, space launch providers, and satellite manufacturers. Companies developing high-efficiency panels, as well as those offering financial strategies for infrastructure financing, are attracting significant venture capital and strategic partnerships. Global energy majors and emerging tech firms are forming new consortia to accelerate market access.

Risks and Market Challenges

Despite its promise, space solar power faces notable challenges. High initial capital expenditures, lengthy regulatory approvals, and the inherent risks of operating in the harsh environment of space require careful risk assessment. Energy transmission safety, space debris management, and potential environmental impacts also warrant ongoing attention from both industry and regulators. Investors are advised to monitor technological maturity and policy developments, as these will influence adoption speeds and commercial viability.

Financial Implications and Future Growth

BloombergNEF forecasts the space solar power market could reach $20 billion in annual investments by 2030. As pilot projects move toward commercialization and international collaborations expand, cost reductions and standardization will drive mainstream integration. Savvy investors are already analyzing impacts on existing solar, wind, and grid infrastructure, as well as the implications for emerging markets with limited terrestrial solar potential. For those willing to navigate uncertainty, the upside potential in space-based solar power is substantial.

How to Position Your Portfolio for the Space Solar Power Revolution

To participate in the unfolding space solar power revolution, investors should conduct in-depth due diligence on both public and private sector actors involved. Identifying companies with proprietary technology, scalable manufacturing, and access to government partnerships can yield competitive advantages. Diversifying across the ancillary supply chain—from microelectronics to launch logistics—can also hedge risk and capture broader sector growth. Utilize investment insights from experienced analysts to stay informed on the latest project milestones, policy changes, and technological advancements that could shape market direction.

Conclusion: The Next Decade of Energy Innovation

The space solar power revolution represents a paradigm shift in how the world generates and distributes energy. Its progression in 2025 is redefining investment opportunities and forcing a reconsideration of geopolitics, sustainability, and disruptive innovation. For investors focused on long-term growth and transformative technologies, space-based solar power is a frontier well worth watching.