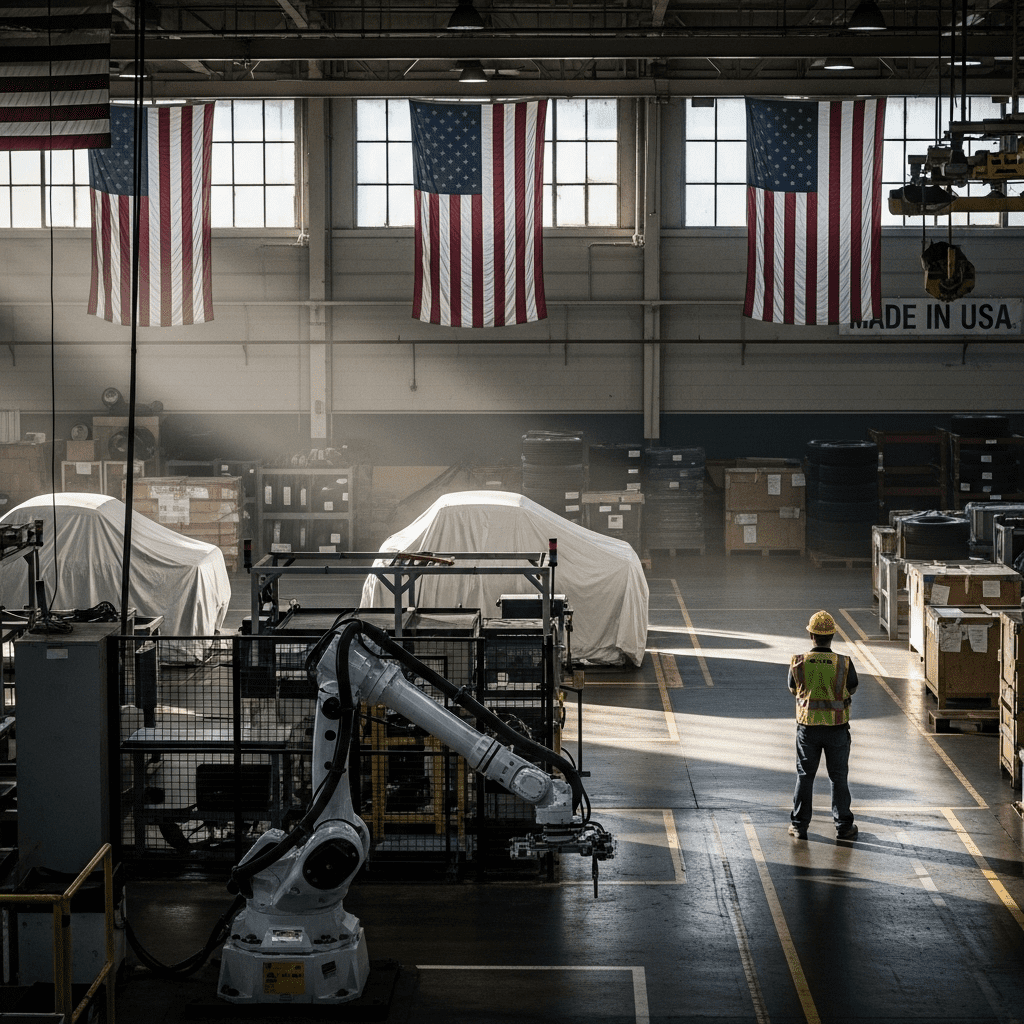

The US automotive industry faces a pivotal moment as Trump’s tariffs drive US car sector into turmoil, spurring dramatic market shifts and mounting challenges for domestic and international manufacturers. As the 2025 policy landscape unfolds, automakers, suppliers, investors, and consumers are grappling with seismic changes that threaten the sector’s competitiveness and future growth.

How Trump’s Tariffs Drive US Car Sector Into Turmoil

In early 2025, the reimplementation and expansion of tariffs on imported vehicles and automotive parts sent shockwaves through the auto sector. Intended to bolster American manufacturing and reduce trade deficits, the tariffs—as high as 25% on cars from the European Union, China, and Mexico—have instead ignited turmoil for US automakers, dealers, and workers. Industry leaders warn the impact is not only immediate but “existential,” threatening vital supply chains and global competitiveness.

According to the American Automotive Trade Association, the resulting cost increases have forced major automakers like Ford, General Motors, and Tesla to revise production targets, reassess global sourcing, and consider plant closures. Industry executives cite rising input costs, supply shortages, and unpredictable consumer demand as some of the most disruptive effects to emerge since the tariffs’ introduction.

Supply Chain Disruptions Complicate Recovery

The tariffs have compounded existing post-pandemic supply chain disruptions. Globally integrated suppliers, which remain crucial for key components such as semiconductors and advanced batteries, now face additional price hikes and delays. As a result, vehicle production cycles have lengthened, and inventory levels for popular models remain historically low. Industry observers on market volatility note that the uncertainty is deterring long-term investment and capital allocation decisions across the auto ecosystem.

Consumer Impact: Prices Rise, Affordability Declines

The fallout from Trump’s tariffs is evident in new and used car prices across the US. Average transaction prices for vehicles have reached record highs in 2025, with some manufacturers imposing additional surcharges to recoup tariff-related costs. This has left many American consumers unable to afford new models, shifting demand toward the used car market and alternative transportation options—a ripple effect also noted in personal finance strategies for 2025.

Auto Dealers and Job Market Face Uncertainty

Dealerships, already challenged by shifts to online sales and electric vehicle adoption, now report contracting sales volumes and compressed margins. The National Automobile Dealers Association predicts job losses among sales, service, and logistics roles, signaling wider economic consequences. As the car sector represents almost 10% of US manufacturing employment, the broader labor market stands vulnerable to extended trade disputes and slowing production.

Global Ambitions at Risk: The Future of the US Auto Industry

Long considered a global leader, the US auto industry risks ceding ground to international competitors as Trump’s tariffs drive US car sector into turmoil. Asian and European automakers with diversified supply chains are already capturing more international market share, while US-based multinationals evaluate shifting production overseas to remain cost-competitive. These trends threaten not only domestic industry strength but also US export volumes—a development closely watched by those seeking global economic trends.

Industry Response: Calls for Negotiation and Innovation

Automakers and trade groups are lobbying federal policymakers for targeted relief, renegotiation of tariffs, and investment in domestic supply chains. Some firms have accelerated innovation, investing in onshore electric vehicle battery plants and next-generation manufacturing technologies. Yet, most agree that unless trade frictions are resolved, the sector faces prolonged instability.

Outlook for Investors: Navigating Continued Volatility

With the full impact of tariffs still unfolding, investment experts caution that volatility in auto stocks, supplier equities, and related ETFs is likely to persist through at least 2025. Analysts recommend closely monitoring trade policy developments, cost structures, and innovation roadmaps when evaluating exposure to the US auto sector. While some contrarian investors may spot long-term value, most advise a prudent, diversified approach amid ongoing market turmoil.

In summary, as Trump’s tariffs drive US car sector into turmoil, the need for strategic adaptation and constructive policy dialogue is more urgent than ever. The coming months will be decisive in shaping the future of American automotive leadership, industrial employment, and consumer opportunity.