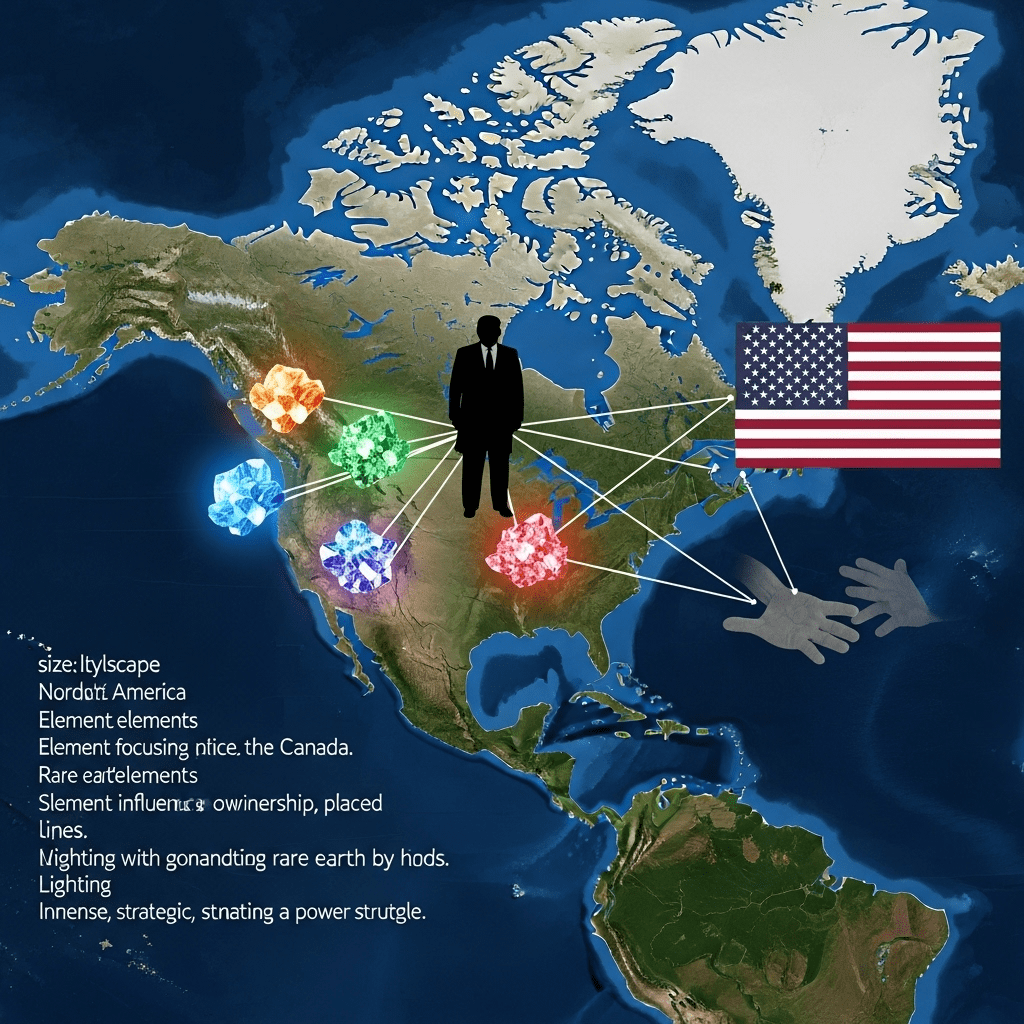

Trump’s takeover of Canadian rare earths miners has sent shockwaves through global markets in 2025, igniting serious debate among investors, governments, and energy sector analysts. The increased American influence over Canada’s coveted rare earth mineral assets is raising concerns about energy independence, supply chain integrity, and international relations.

Trump’s Takeover Of Canadian Rare Earths Miners: Implications For The Energy Sector

The aggressive acquisition pattern, driven by private equity funds linked to Donald Trump’s associates, has thrust Canada’s rare earth mining sector into the spotlight. Rare earth elements such as neodymium, dysprosium, and terbium are vital for the production of high-performance magnets, electric vehicle batteries, wind turbines, and advanced defense technologies. As nations worldwide expedite the transition to clean energy, these minerals are now deemed a strategic priority.

North American Supply Chains And Strategic Dependencies

Since early 2024, a series of investments and takeovers involving Canadian rare earth mining companies have been traced back to U.S.-based consortiums, some reportedly associated with Trump-connected funds. This consolidation has stirred concerns in both Ottawa and Washington regarding North American control over critical minerals. Canada, traditionally wary of foreign influence in its mining sector, is considering new regulatory frameworks to review such transactions more stringently.

Industry experts fear that unchecked American leverage could distort pricing, supply guarantees, and even political leverage in the region. For global energy stakeholders seeking stable commodity markets, this marks a pivotal risk to diversification goals across renewable energy supply chains.

Geopolitical Risks Amplified By Trump’s Rare Earths Strategy

The move has far-reaching geopolitical implications. As the United States attempts to wean itself off Chinese rare earth imports, gaining control over Canadian mines could cement its influence over North America’s clean technology industries. However, this raises alarm bells among Canadian policymakers and allied nations, who worry that the consolidation could disrupt cooperation, inhibit Canadian sovereignty, or trigger retaliatory trade policies from China and other critical players.

Regulatory and Political Responses in Canada

In response to Trump’s takeover of Canadian rare earths miners, Canada’s government has initiated a review of the Investment Canada Act, aiming to expand the definition of “net benefit” and national security to include rare earths, lithium, and other energy-critical minerals. The question of whether to grant special protections for domestic firms is now a central debate on Parliament Hill.

Market participants are closely following government hearings, noting parallels to moves in Australia and the European Union, where governments have placed stricter controls on foreign investment in strategic sectors. Investors looking for policy trends must monitor Canada’s evolving regulatory landscape to gauge how these changes may impact future deal flow or valuation of rare earth miners.

Market Impact and Investment Risks

For investors, the Trump-linked acquisitions have created short-term volatility in Canadian mining stocks. Some rare earth miners have posted sharp gains on acquisition speculation, while others, perceived as vulnerable targets, have seen increased trading volume and price swings. Leading asset managers caution that valuation premiums could be unsustainable if regulatory or diplomatic pushback intensifies.

Analysts at leading energy consultancies underscore that global demand for rare earths will continue to surge as electric vehicles, grid storage solutions, and renewable infrastructure expand. Nonetheless, overconcentration of ownership threatens competition and market resilience, risking higher prices for end users and manufacturing sectors in both the U.S. and Canada.

Outlook: Protecting Critical Minerals In The Era Of Strategic Competition

Trump’s takeover of Canadian rare earths miners epitomizes the intersection of resource security, investment risk, and geopolitics in 2025. Both governmental and private entities in North America now face the dual challenge of building robust supply chains while balancing foreign direct investment with national interests.

As the Biden and Trudeau administrations weigh their policy options, industry leaders emphasize the importance of establishing transparent, predictable, and cooperative frameworks for cross-border mineral development. For those seeking diversified portfolio strategies in energy and critical materials, navigating these complexities will be essential.

Looking ahead, the battle over rare earths ownership and oversight will remain a defining issue for energy investors, mining executives, and policymakers alike. The unfolding drama of Trump’s takeover of Canadian rare earths miners signals a new era of strategic competition—one where resource nationalism and industrial security will shape the future of energy transition worldwide.