As Ukraine seizes diplomatic opportunity with Central Asian states, the energy landscape of Eurasia is poised for a strategic transformation. With new geopolitical uncertainties and evolving global demand, Ukraine’s latest diplomatic overtures toward Kazakhstan, Uzbekistan, Turkmenistan, Kyrgyzstan, and Tajikistan reflect an ambitious bid to diversify its energy portfolio and secure vital investments for a volatile decade.

Ukraine Seizes Diplomatic Opportunity with Central Asian States for Strategic Energy Cooperation

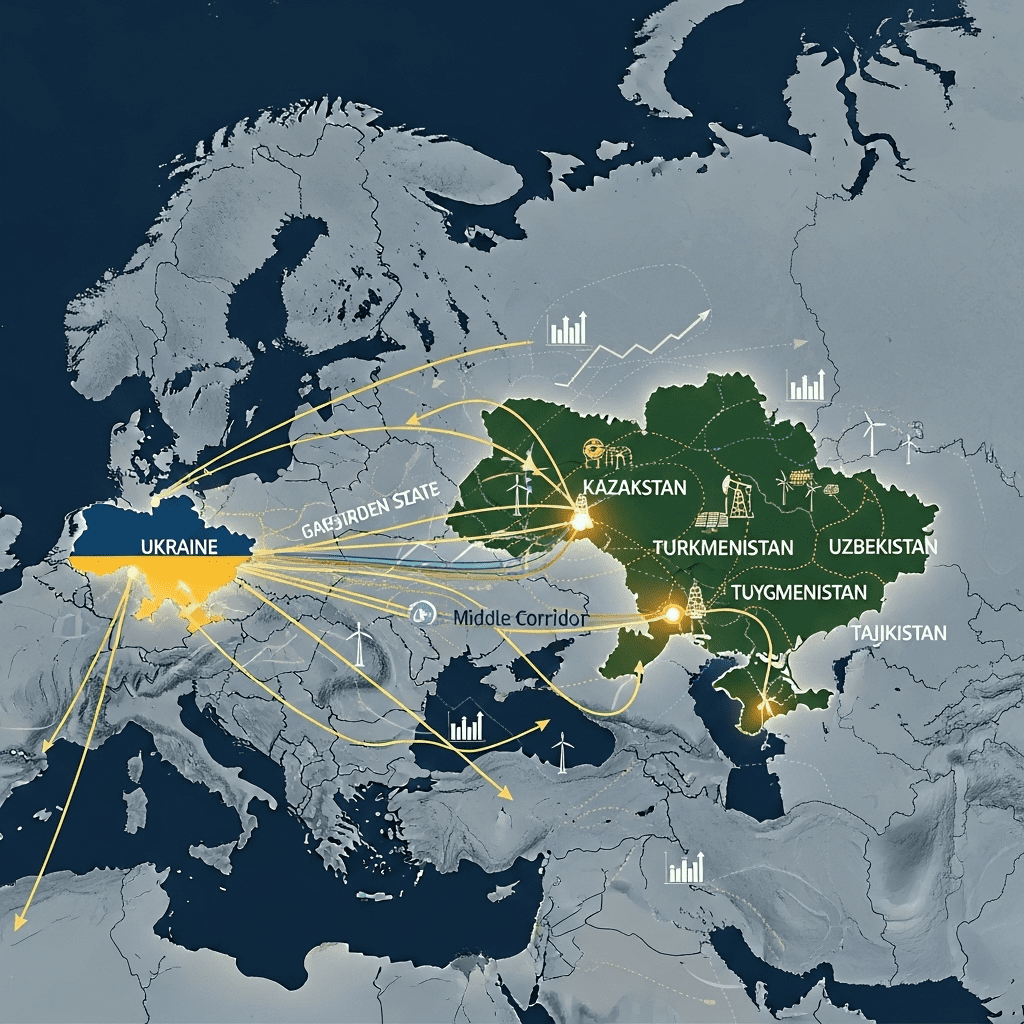

Since early 2024, Ukrainian officials have intensified high-level talks with their Central Asian counterparts. The primary aim: to build partnerships that make Ukraine less dependent on Russian fossil fuels while simultaneously unlocking new trade corridors for gas, oil, and critical minerals. This strategy is not just about energy security—it supports Ukraine’s wider integration with European and global markets, capitalizing on mutual interests in technology transfer, infrastructure, and green energy development.

Central Asia’s vast reserves of gas, oil, and rare earth elements have become increasingly attractive for Ukraine’s post-war reconstruction plans. The region’s nations, too, seek diverse trade partners as they hedge against regional power shifts and Western sanctions on Russia. Emerging agreements on joint ventures and investment in energy transport infrastructure underscore the potential for mutually beneficial growth. This is of keen interest to financial analysts and institutional investors tracking geopolitical risk management strategies in the region.

Growth of Energy Trade and Green Infrastructure

The most tangible result of Ukraine seizing diplomatic opportunity with Central Asian states has been progress in the energy sector. Ukrainian energy enterprises are exploring direct oil and gas imports from Kazakhstan and Turkmenistan, bypassing traditional Russian-controlled routes. Additionally, Ukrainian grid operators have initiated discussions on synchronized green energy projects, drawing on Uzbekistan’s expertise in solar and wind energy, which aligns with EU decarbonization goals for 2030 and beyond.

There is also growing interest in the transport infrastructure needed to facilitate this east-west flow. The “Middle Corridor”—a trade route traversing Central Asia, the Caucasus, and the Black Sea—could see increased traffic if Ukraine and these states deepen logistical and regulatory cooperation. Analysts expect this diversification to stabilize not only Ukraine’s energy reserves but also support regional economic resilience, with ripple effects throughout Euro-Asian energy markets. Investors monitoring emerging market opportunities should note how these trends could influence future commodity prices and infrastructure funding.

Financial Implications: Investment, Risk, and Opportunity

The financial implications of Ukraine’s new diplomatic and energy alliances are far-reaching. By collaborating with Central Asian states, Ukraine improves the security of its energy supplies and signals a more attractive environment for international investors. Western financial institutions and multilateral banks are likely to support projects that enhance connectivity, especially green power corridors linking Central Asia, Ukraine, and Europe.

However, challenges abound. The success of these diplomatic endeavors relies on political stability in Central Asia and Ukraine’s ability to maintain regulatory reforms and anti-corruption efforts. There remains underlying competition with Russia and China, both of which are major stakeholders in Eurasian energy logistics. This makes careful risk assessment vital for institutional investors and fund managers exploring diversification strategies in 2025.

Outlook for Ukraine-Central Asia Energy Diplomacy in 2025

As Ukraine seizes diplomatic opportunity with Central Asian states, the outlook for 2025 is cautiously optimistic. Current dialogue has set the stage for formal trade agreements, joint ventures in hydrogen and renewables, and enhanced rail and pipeline connectivity. These evolving relationships may also have a stabilizing effect on the energy security situation in Eastern Europe and broaden Europe’s overall resource base at a time of sustained uncertainty.

In a world where energy flows are increasingly determined by diplomacy as much as geology, Ukraine’s assertive engagement with Central Asian states stands as one of the most dynamic developments to watch this year. Institutional investors, energy traders, and policymakers will be closely tracking these alliances for signals of future market direction, regional growth, and opportunities in sustainable infrastructure.