The financial markets were rocked this week as US stocks close sharply lower after Trump threatens new China tariffs, renewing fears of a trade war between the world’s two largest economies. With uncertainty dominating Wall Street, investors are left weighing the broader implications for economic growth, portfolio stability, and the global investment climate.

US stocks close sharply lower after Trump threatens new China tariffs: Examining Market Reaction

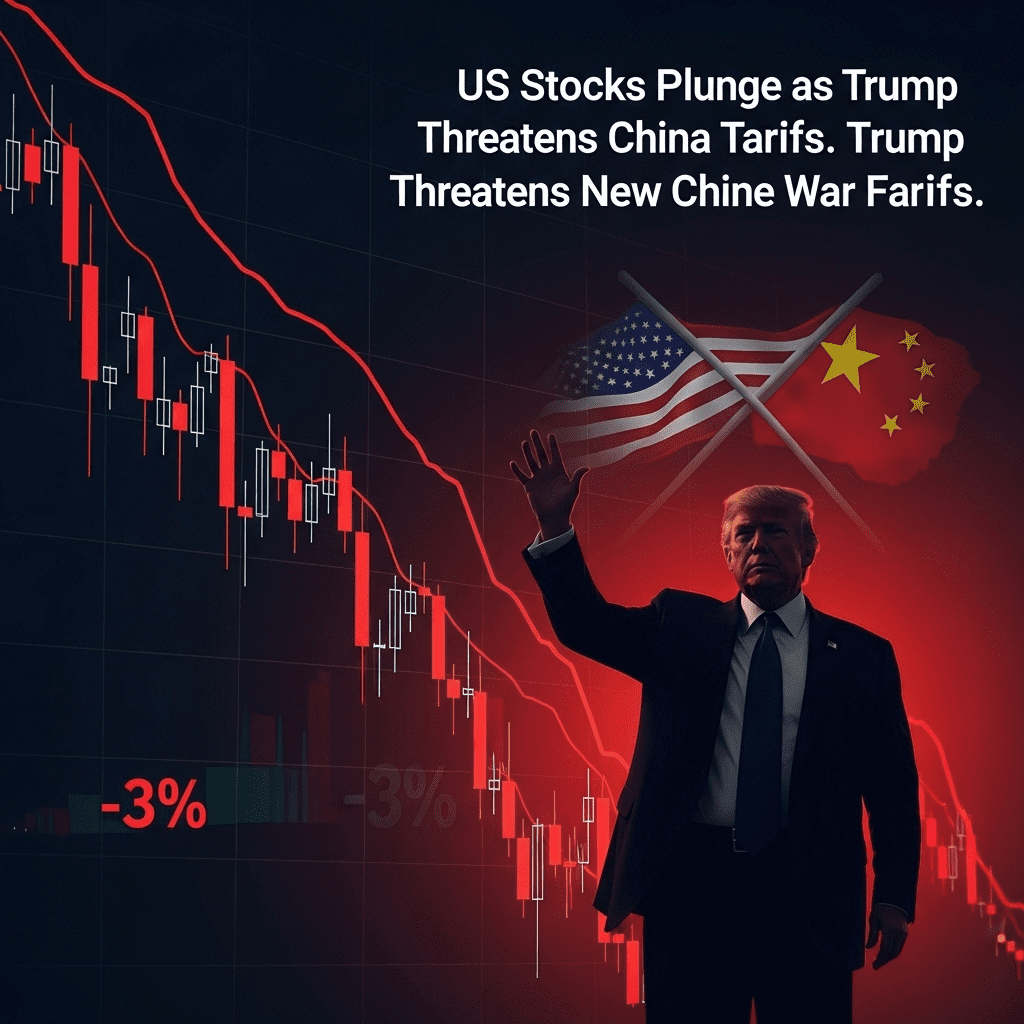

Major U.S. indices plummeted in response to former President Donald Trump’s statements on potentially increasing tariffs on Chinese goods should he return to office in 2025. The S&P 500 posted a 3% decline, the Nasdaq lost nearly 3.5%, and the Dow Jones Industrial Average fell by over 850 points, marking one of the steepest sell-offs of the year.

Traders cited a surge in market volatility as institutional and retail investors engaged in wholesale repositioning. Sectors most reliant on U.S.-China trade, including technology, manufacturing, and agriculture, were particularly hard hit. Heavyweights such as Apple, Caterpillar, and Boeing saw their shares tumble amid worries about supply chain disruptions and pressure on corporate earnings.

Investor Sentiment and Safe Haven Plays

As risk aversion swept the markets, investors flocked to traditional safe havens. U.S. Treasury yields dropped as bond prices climbed, and gold prices rallied to multi-month highs. According to analysts at ThinkInvest’s macroeconomic research, this flight to safety reflects concerns about escalating U.S.-China tensions putting downward pressure on economic prospects in 2025.

What’s Driving Volatility in 2025?

The announcement about possible new tariffs on China comes at a fragile moment for the global economy. Lingering inflation, central bank tightening cycles, and geopolitical uncertainty were already testing market resilience. Trump’s renewed tariff threats stoked fears that a new round of retaliatory measures from Beijing could undermine global supply chains and stall economic growth, both domestically and abroad.

In a statement, Trump emphasized that any future trade policy would aim to “protect American industry and jobs,” sparking speculation about the nature and scope of potential tariffs. Analysts caution that while protectionist rhetoric often impacts sentiment, the mere threat can prompt companies to begin repositioning supply chains, inventory strategies, and capital allocation, even before policy changes take effect.

Economic Impact: Will Growth Stagnate?

Economists warn that aggressive tariff escalation may have a chilling effect on U.S. economic momentum, potentially reversing recoveries in sectors like manufacturing and agriculture. If China responds with equivalent trade barriers, American exporters could see reduced demand, translating to lower revenues and potential job losses.

Historically, as seen during the previous rounds of U.S.-China trade tensions in 2018-2019, higher tariffs led to declines in global trade volumes and increased costs for American businesses and consumers. The Federal Reserve’s ongoing efforts to temper inflation could also be complicated if input prices rise due to trade frictions.

How Should Investors Respond to Volatile Markets?

Amid headlines that US stocks close sharply lower after Trump threatens new China tariffs, market experts at ThinkInvest’s portfolio strategies section advise caution but emphasize the value of diversification and defensive positioning. Investors are urged to review their portfolio allocations, especially regarding sectors heavily exposed to tariffs or reliant on international trade.

Financial planners suggest considering high-quality dividend stocks, sectors with resilient demand, and assets that historically perform well during volatility, such as gold or U.S. Treasurys. In addition, maintaining a cash buffer can provide flexibility to capitalize on short-term dislocations when risk appetite eventually returns.

Looking Ahead: Key Events to Watch

Market watchers are keeping a close eye on upcoming statements from both the U.S. and Chinese governments, looking for signs of de-escalation or further confrontation. The Federal Reserve’s communication regarding potential monetary policy adjustments in light of geopolitical shocks will also be critical for risk sentiment.

Long-term investors would do well to monitor not just trade headlines, but also company earnings guidance, economic indicators, and global growth projections. According to a recent economic outlook published by ThinkInvest.org, agility and information-driven strategies could offer a competitive edge in this period of heightened uncertainty.

Conclusion: Navigating a Shifting Landscape

With US stocks close sharply lower after Trump threatens new China tariffs, the market’s swift reaction signals the sensitivity of global finance to trade policy changes, especially in a polarized electoral environment. While volatility may persist, history suggests that periods of market turbulence can also create opportunities for patient, disciplined investors who focus on fundamentals, prudent risk management, and long-term value creation.