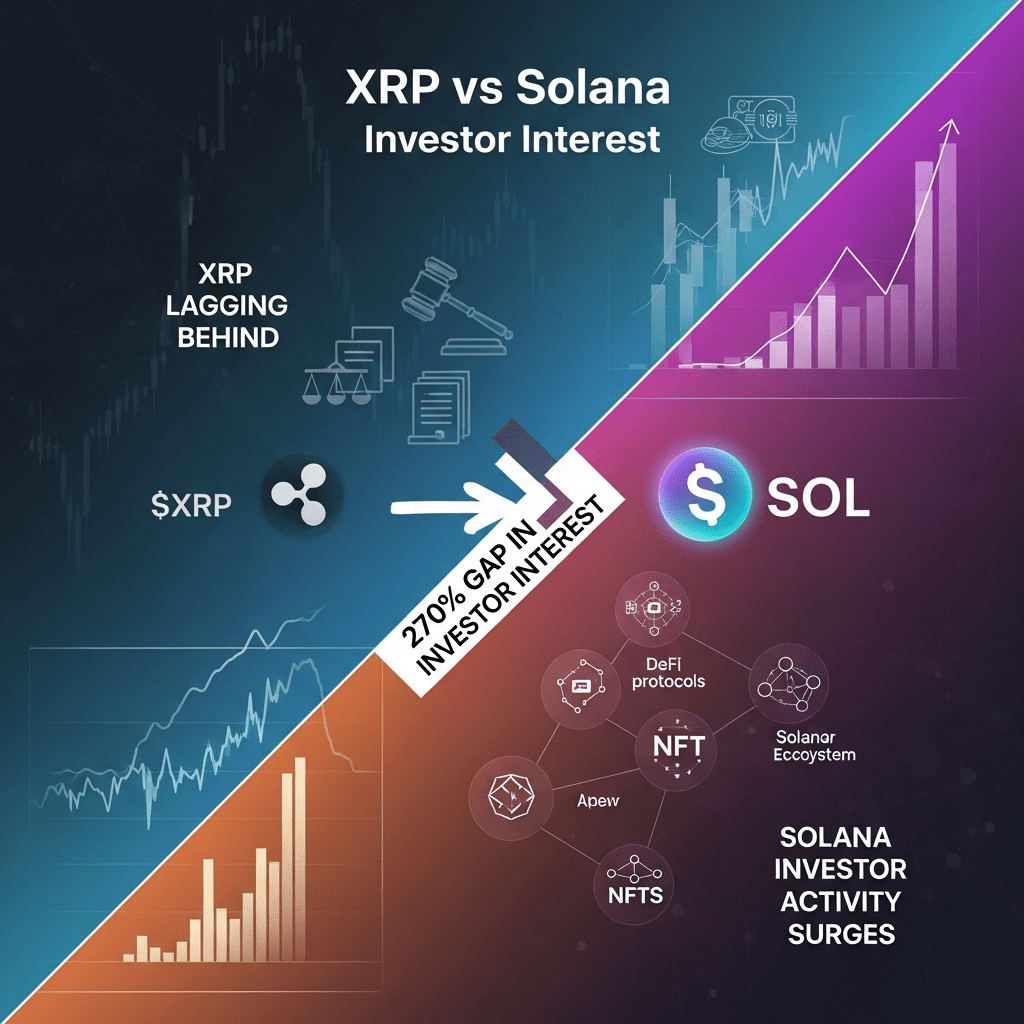

XRP ($XRP) and Solana ($SOL) revealed a very wide gap in investor interest this week, catching analysts off guard as market data shows a 270% difference in transaction volumes. The focus keyphrase XRP vs Solana investor interest is quickly becoming a top query among crypto observers seeking insight on this market anomaly.

Solana Investor Activity Surges While XRP Lags Behind

According to CoinMarketCap data as of November 15, 2025, Solana ($SOL) posted a 24-hour trading volume of $4.6 billion, marking a 35% increase over the previous seven-day average. By contrast, XRP ($XRP) registered just $1.25 billion in trading volume, declining 5% week-over-week. This 270% gap illustrates a dramatic shift, underscored by Binance order book data showing Solana trade frequency outpacing XRP by a margin of 3-to-1 on November 14. CryptoCompare’s latest asset flows report, published November 12, attributes rising Solana appetite to its recent integration into multiple DeFi platforms, while XRP churn fell despite Ripple’s ($XRP) ongoing legal clarity in US courts.

Why Altcoin Sector Sentiment Is Diverging After Q4 Surge

The divergence between XRP and Solana extends beyond just these two tokens, hinting at deeper changes in altcoin sector sentiment. Since the start of Q4 2025, Solana has rallied 42% while XRP has gained only 9%, per Messari’s November 2025 altcoin index. This performance gap comes as Layer 1 blockchain tokens, especially those with strong DeFi and NFT ecosystems, attract renewed capital inflows. CoinShares’ Digital Asset Fund Flows report (November 10, 2025) observed $54 million net inflows to Solana-based ETPs over the past 30 days, as institutional demand for programmable blockchains rose sharply. Meanwhile, XRP fund inflows remained flat, reflecting ongoing uncertainty over real-world utility adoption despite the recent favorable ruling for Ripple in US district court. These trends underscore a wider fragmentation in altcoin investor preference not seen since the 2021 bull market.

How Investors Can Capitalize on XRP vs Solana Divergence

For portfolio managers navigating the XRP vs Solana investor interest gap, risk-adjusted positioning is key. Traders holding Solana may seek to capitalize on short-term momentum, but should heed potential volatility as open interest on derivatives platforms hits a new yearly high, according to The Block’s November 2025 derivatives review. Meanwhile, XRP-heavy portfolios face relative stagnation and may benefit from a balanced exposure to alternative Layer 1s. Crypto ETF allocators are increasingly trimming XRP allocations in favor of Solana, Polygon ($MATIC), and Avalanche ($AVAX) to reflect changing sector leadership, as detailed in Galaxy Digital’s Q3 allocation report. Prudent investors are watching for cross-market catalysts, such as the upcoming Ethereum ($ETH) network upgrade, which could impact both asset classes. For current cryptocurrency market trends and sector forecasts, resources like cryptocurrency market trends and comprehensive investment strategy insights remain vital. Diversification remains a priority as inter-token correlations weaken against a backdrop of surging DeFi activity.

Analysts See Solana Outperformance Continuing Into 2026

Industry analysts observe that the current momentum behind Solana is likely to persist into early 2026, citing robust developer activity and user adoption as primary drivers. Market consensus suggests that until XRP demonstrates stronger network usage metrics and new institutional partnerships, the interest gap may widen further. Crypto market strategists at Kaiko Research (November 2025) indicate that investors are closely tracking not just price action but also on-chain transaction throughput and application growth to guide long-term positioning.

XRP vs Solana Investor Interest Signals Rotation in Crypto Markets

The very wide gap in XRP vs Solana investor interest highlights a clear rotation underway within the digital asset landscape. Investors should monitor trading volumes, sector fund flows, and ecosystem developments as new market leaders emerge. The evolution of XRP vs Solana investor interest in coming months may shape altcoin allocations through 2026, presenting both risks and opportunities for agile crypto market participants.

Tags: XRP, Solana, crypto market trends, altcoin investing, $SOL