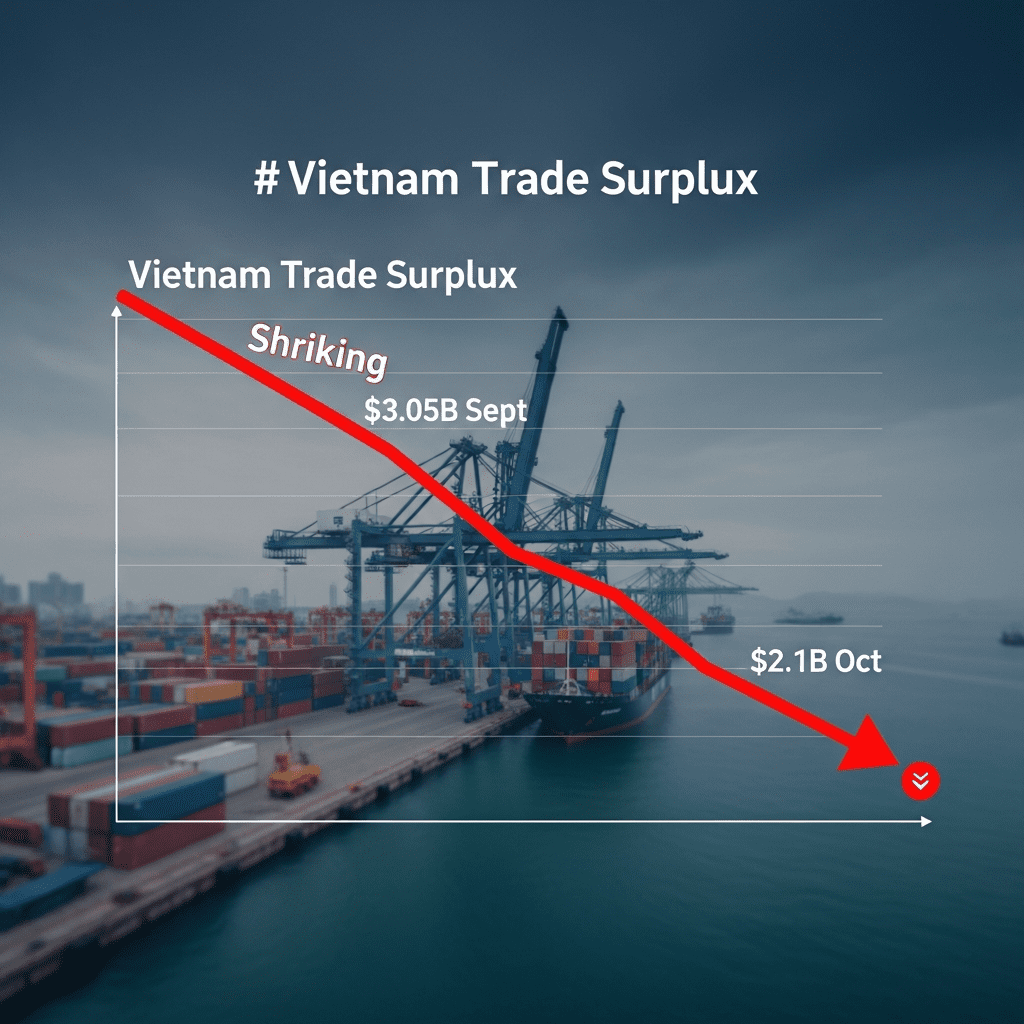

Vietnam’s trade surplus shrinks sharply as the nation’s exports fall short of expectations, according to the latest data from the General Statistics Office ($VNINDEX). October results challenge analyst forecasts, fueling fresh concerns about regional export stability. What’s behind this unexpected slowdown in Vietnam trade surplus shrinks momentum?

Vietnam’s Trade Surplus Drops to $2.1B as October Exports Miss Target

Vietnam’s trade surplus dropped to $2.1 billion in October 2025, plunging 31% from the $3.05 billion recorded in September, the General Statistics Office reported on November 5. Total exports rose just 4.1% year-on-year to $32.3 billion, falling short of economists’ $33.5 billion consensus projection (Bloomberg, Nov. 2025). Key export categories such as electronics and textiles decelerated, with electronics shipments up only 2%, vastly underperforming the 7% pace seen a year prior. Imports beat expectations, rising 9.2% to $30.2 billion, signaling strong domestic demand even as external markets soften.

How the Export Shortfall Impacts Asia’s Manufacturing Outlook

Vietnam’s export deceleration reverberates across Asia’s manufacturing supply chains, especially as the nation is often viewed as a bellwether for regional demand. Sluggish electronics and apparel shipments mirror a wider slowdown in Asian exports noted by the Asian Development Bank in its Q3 2025 sector report. The International Monetary Fund’s October 2025 Asia-Pacific Economic Outlook highlighted Vietnam’s export-driven GDP expansion, but warned that softer global demand and elevated US interest rates could weigh on growth through year-end.

How Investors Are Adjusting Portfolios Amid Vietnam’s Export Slowdown

Investors recalibrate exposures to Vietnamese manufacturing and Southeast Asian equities, with the shortfall in trade surplus amplifying volatility in regional supply chain stocks. Vietnam’s VN-Index ($VNINDEX) slipped 1.7% on November 5, led by declines in Samsung Electronics’ Vietnamese suppliers and major textile exporters. ETF flows into Vietnamese equities moderated, while capital rotated into broader Asian stock market analysis and forex trading insights as investors assessed currency risks. Portfolio managers remain watchful for policy support, such as Vietcombank’s ($VCB) recent rate revisions, and are closely tracking upcoming earnings projections of key export sectors. Latest financial news continues to spotlight shifts in trade dynamics as a trigger for near-term rebalancing.

Analysts Expect Vietnam’s External Sector to Face Ongoing Pressure

Market strategists at HSBC and regional brokers consider the October trade data a sign that Vietnam’s external sector may face persistent headwinds into early 2026. Industry analysts observe that, unless US consumer demand rebounds or China’s reopening catalyzes regional orders, export recovery could remain subdued. Investment strategists note that a stabilization in global electronics demand is crucial for Vietnam’s flagship manufacturing base.

Vietnam Trade Surplus Shrinks Signals Volatility for Asia Investors in 2025

Mounting evidence that the Vietnam trade surplus shrinks underscores rising volatility for investors in Asia’s manufacturing and export sectors. Upcoming PMI releases and holiday season order trends will provide essential signals for exposure management. Investors should monitor currency developments and watch for potential government stimulus measures to counter ongoing external pressures.

Tags: Vietnam, trade surplus, VNINDEX, Asia exports, manufacturing