What Happened

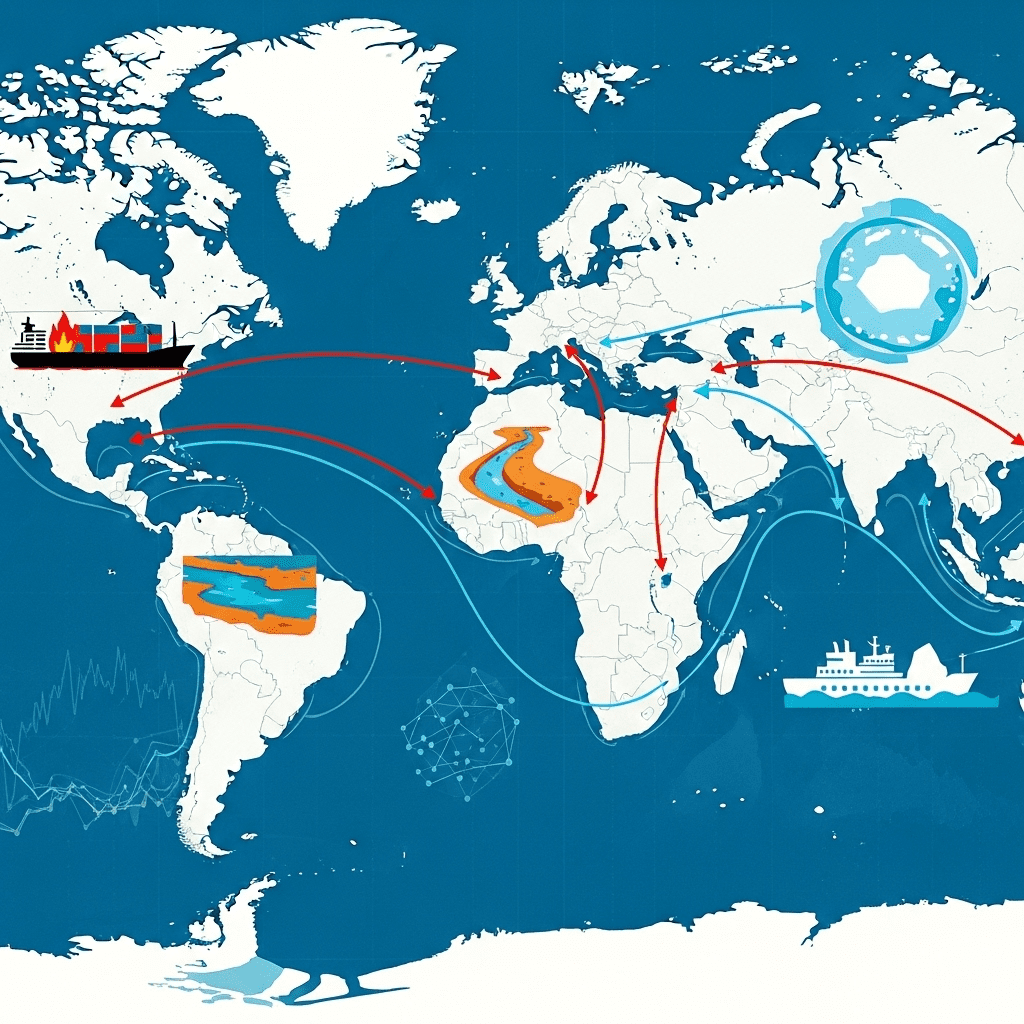

Throughout 2024 and into 2025, the dual forces of war and climate change have combined to dramatically reroute global trade networks. Conflict in the Red Sea and Ukraine has disrupted major shipping lanes, while persistent droughts and extreme weather—such as the low water levels in the Panama Canal—have strained logistical arteries. According to Bloomberg, container traffic through the Panama Canal fell 20% year-on-year in the first quarter of 2025, as water shortages limited transit slots. Simultaneously, shipping insurers have hiked premiums for vessels navigating conflict zones, notably amid attacks on vessels in the Red Sea, further increasing costs and delays for importers and exporters. The focus keyphrase—war and climate change global trade routes—has shifted from headline risk to a defining challenge for energy and logistics sectors, with companies rerouting an estimated 15% of global goods through alternative, longer paths (Reuters, May 2025).

Why It Matters

The redrawing of trade routes under pressure from war and climate change has profound economic consequences. Extended routes mean higher shipping costs, longer delivery times, and increased carbon emissions—complicating ESG commitments. For energy markets, especially LNG and oil, the shift alters traditional supply-and-demand balances: European buyers are importing more from the U.S. Gulf and West Africa as Middle East supplies become less reliable. According to the International Energy Agency, rerouted shipments increased average voyage distances for crude oil by 8% between late 2023 and early 2025. Historical comparisons underscore the significance; disruptions rival the Suez Crisis of 1956, but with far broader and environmentally driven dimensions. Analysts caution that persistent volatility may redefine just-in-time logistics and global pricing benchmarks.

Impact on Investors

For investors, the redrawn landscape of global trade presents both risks and tactical opportunities. Higher freight rates boost shipping stocks, with the investment insights referencing the Shanghai Containerized Freight Index up 18% year-to-date. Energy majors such as ExxonMobil (XOM) and Royal Dutch Shell (SHEL) are revising supply strategies to mitigate regional bottlenecks, while logistics and port infrastructure firms like A.P. Moller-Maersk (MAERSK-B.CO) are seeing increased capital inflows. Conversely, manufacturers reliant on tightly synchronized supply chains may experience earnings pressure from unpredictable delays and surging logistics costs. “Investors should brace for elevated volatility and focus on firms with diversified supply options,” says Elena Morales, transport sector analyst at JP Global Advisors. As routes shift, risk assessment and exposure to conflict regions become critical to portfolio resilience; the latest market analysis highlights both insurance and alternative energy sectors as integral hedges.

Expert Take

Market strategists suggest the accelerating interplay of war and climate change with global trade routes will force a revaluation of traditional energy and logistics valuations. Analysts note that companies investing in adaptive infrastructure and flexible supply networks may outperform peers locked into legacy trade corridors.

The Bottom Line

The ongoing reshaping of global trade routes by war and climate change poses sustained volatility for investors across energy, shipping, and logistics. As the global supply map is redrawn, businesses and investors must adapt their strategies to novel risks and emerging opportunities. Staying informed through resources like ThinkInvest’s research updates is essential as the focus on war and climate change global trade routes intensifies in 2025 and beyond.

Tags: energy markets, supply chain, global trade, climate risk, shipping logistics.