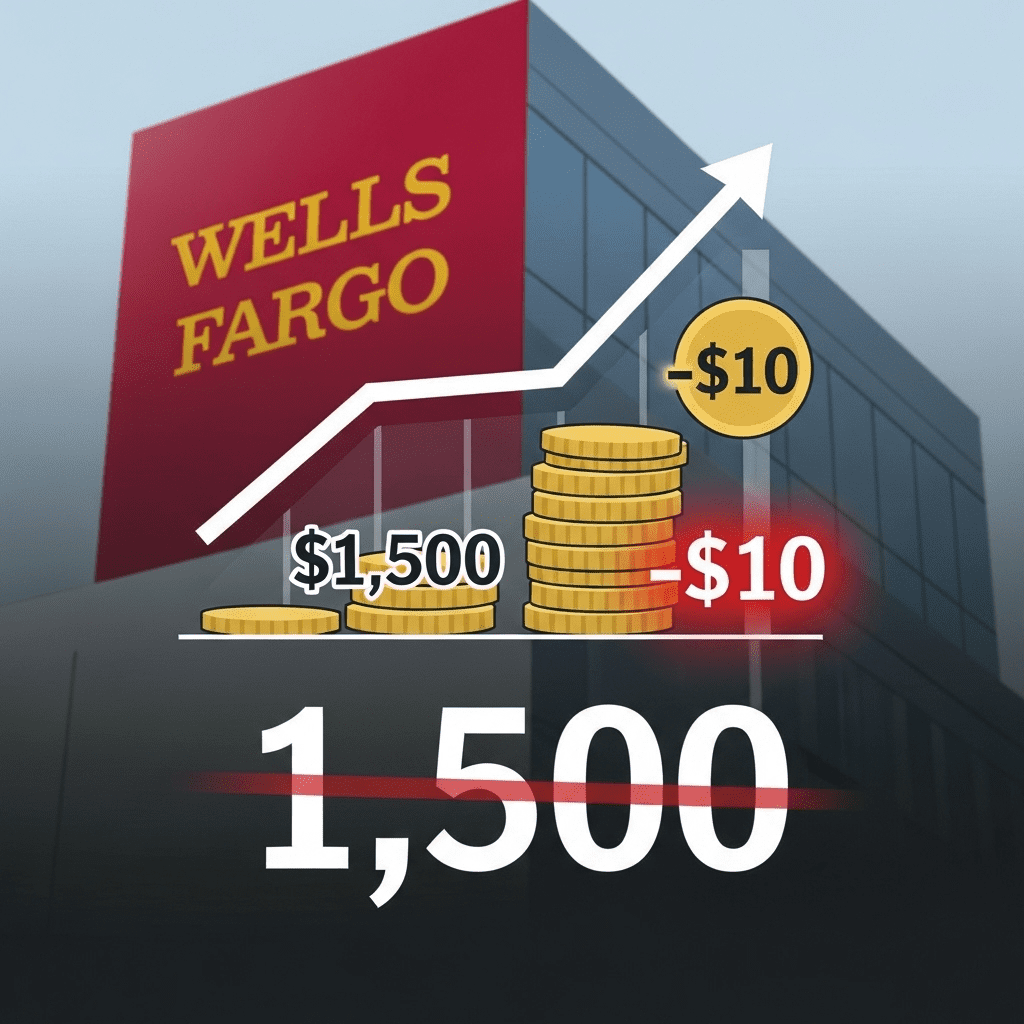

Wells Fargo ($WFC) revealed that customers with less than $1,500 in their accounts could face new monthly fees, sparking concern among everyday banking clients. The latest Wells Fargo account balance fee puts millions at risk of unexpected charges—and the timing surprises many just ahead of the holiday spending season.

Wells Fargo’s New $10 Maintenance Fee Hits Low Balances

Wells Fargo ($WFC) instituted a $10 monthly maintenance fee for everyday checking accounts holding less than $1,500, effective October 28, 2025. According to the company’s official schedule of fees, the previous minimum to avoid charges was $500, marking a substantial 200% increase in the required non-waivable balance. As of Q3 2025, Wells Fargo serviced over 45 million consumer bank accounts in the U.S., per its SEC filings. The move comes as banks seek new revenue amid falling net interest margins and rising deposit competition (source: Wells Fargo fee schedule, October 2025; SEC 10-Q, Q3 2025).

How Rising Wells Fargo Fees Reflect Broader Bank Sector Pressures

Higher minimum balance requirements at Wells Fargo echo similar actions across U.S. banking in 2025, as traditional banks face growing pressure from digital challengers and persistent low yields. According to data from the FDIC, national average checking account fees rose to $8.45 in September 2025, up 18% year-over-year. Simultaneously, online-only banks—such as Chime and Ally—reported a 22% increase in new customer accounts since January 2025 (The Financial Brand, August 2025). Experts attribute these shifts to shrinking loan growth and compressed interest margins, forcing legacy banks to rely more on fee-based income. These trends place further strain on lower-balance customers at major institutions like Wells Fargo.

Actionable Account Strategies for Investors Amid Fee Increases

Investors and account holders must evaluate their banking strategies carefully in light of the new Wells Fargo account balance fee. Customers maintaining regular balances below $1,500 should consider alternative products, such as no-fee online checking or direct deposit setups that waive monthly charges. Bank investors should monitor deposit outflows and migration to digital providers—as reported in recent stock market analysis and latest financial news. The Wells Fargo change also underscores potential sector-wide risks for traditional U.S. banks, especially as depositors grow increasingly fee-sensitive in a higher-cost environment.

What Experts Predict for U.S. Bank Fees and Consumer Habits

Investment strategists note that fee sensitivity will likely accelerate the shift toward digital banks and alternative financial products through 2026. According to analysts at Moody’s (Banking Outlook, September 2025), large U.S. banks could see a notable decline in small-dollar retail accounts if minimum balance requirements keep rising. Industry analysts observe that widespread fee adjustments may impact consumer trust at legacy institutions, driving further structural changes in the sector.

Wells Fargo Account Balance Fee Signals Banks’ New Revenue Playbook

With the Wells Fargo account balance fee taking effect, investors and customers should expect continued upward pressure on banking costs into 2026. Monitoring the $1,500 threshold—and comparing alternatives—is now critical to minimizing avoidable account fees. As banks adapt their business models, this development signals a pivotal shift in how both depositors and investors engage with the U.S. financial system.

Tags: Wells Fargo, WFC, bank fees, retail banking, account balance