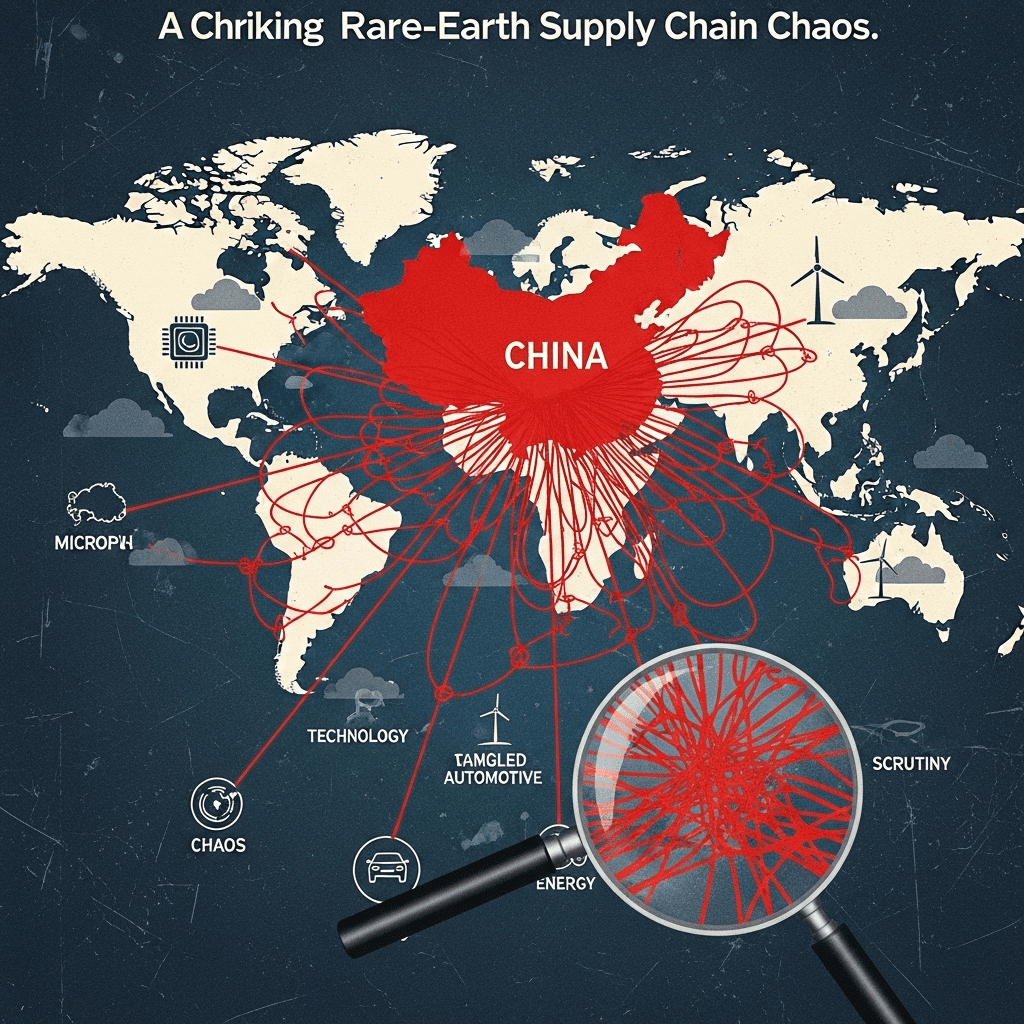

The growing concerns over China rare-earth supply chain chaos have triggered alarm among Western companies, raising the specter of widespread disruption across technology, automotive, and energy sectors in 2025. As China tightens export control and regulatory oversight, businesses are bracing for delays and soaring costs in sourcing these critical minerals.

China Rare-Earth Supply Chain Chaos Reshapes Global Markets

China dominates over 80% of global rare-earth processing, playing a pivotal role in materials essential for electric vehicles, wind turbines, advanced electronics, and military hardware. The latest warnings from Western firms highlight the vulnerability of existing supply chains, as ongoing geopolitical tensions and export restrictions intensify China rare-earth supply chain chaos.

According to industry analysts, a confluence of factors—such as increased scrutiny of overseas contracts, restrictive export quotas, and stricter environmental checks—has led to extended lead times and pricing volatility. For Western multinationals, this introduces significant operational and financial risk, particularly when it comes to securing neodymium, praseodymium, dysprosium, and terbium—metals that have no scalable substitutes for use in permanent magnets and other high-tech applications.

Impact on Critical Industries

The ramifications of the current situation extend far beyond the resource sector. As highlighted by financial news outlets and echoed by executives at top U.S. and European manufacturers, the unfolding supply crunch threatens the timely production of electric vehicles and consumer electronics—industries that rely heavily on the uninterrupted flow of rare-earth elements. Major automakers warn that delivery delays and rising costs could derail their electric fleet plans, while technology firms anticipate increased competition for scarce materials, potentially raising prices for end consumers.

Recent reports indicate that at least a dozen Western companies, including firms from the aerospace, defense, and renewable energy sectors, have flagged the mounting risks during Q1 2025 earnings calls. Many are now actively seeking alternative suppliers in Australia, Canada, and Africa, although bringing new projects online remains slow and capital-intensive. For example, the financial website ThinkInvest.org notes that while investments in non-Chinese rare-earth projects are accelerating, output is unlikely to match current demand in the short to medium term.

Strategies for Navigating China Rare-Earth Supply Chain Chaos

To mitigate exposure to China rare-earth supply chain chaos, Western companies are deploying a mix of risk management strategies. These include increasing stockpiles of critical minerals, renegotiating supply agreements, and investing in recycling and substitution technologies. Some conglomerates are forming joint ventures with rare-earth miners outside China, while others are leveraging digital tools to monitor supply chain vulnerabilities in real time.

Analysts emphasize the importance of diversified sourcing, but warn that such transitions come with higher upfront investment and technical hurdles. Investors tracking this sector on resources like emerging markets research point out that building a resilient supply chain is a years-long endeavor, often constrained by regulatory, environmental, and logistical challenges.

Policy Developments and the Global Response

In response to the crisis, Western governments have started to ramp up funding support for domestic rare-earth mining and processing initiatives. The U.S. and EU have both announced new policy frameworks designed to fast-track permitting and reduce dependence on single-source suppliers. However, experts caution that long-term success will depend on ongoing collaboration between public and private sectors, as well as global trade partners.

Reports from financial authorities and respected investment forums such as geopolitical risk analysis indicate that markets will continue to experience turbulence until the structural imbalance in rare-earth supply chains is addressed. In the interim, companies and investors are urged to maintain agile procurement strategies and closely monitor government actions related to tariffs, export bans, and strategic reserves.

Outlook: Managing Uncertainty Amid China Rare-Earth Supply Chain Chaos

Looking ahead, experts forecast that China rare-earth supply chain chaos will remain a central risk factor for Western manufacturers and global markets throughout 2025. While long-term initiatives to diversify supply and bolster resilience are underway, short-term pain is likely as industries adjust to new realities. For the financial community, proactive due diligence and adaptability will be crucial as the world navigates this pivotal period of resource competition and economic transformation.