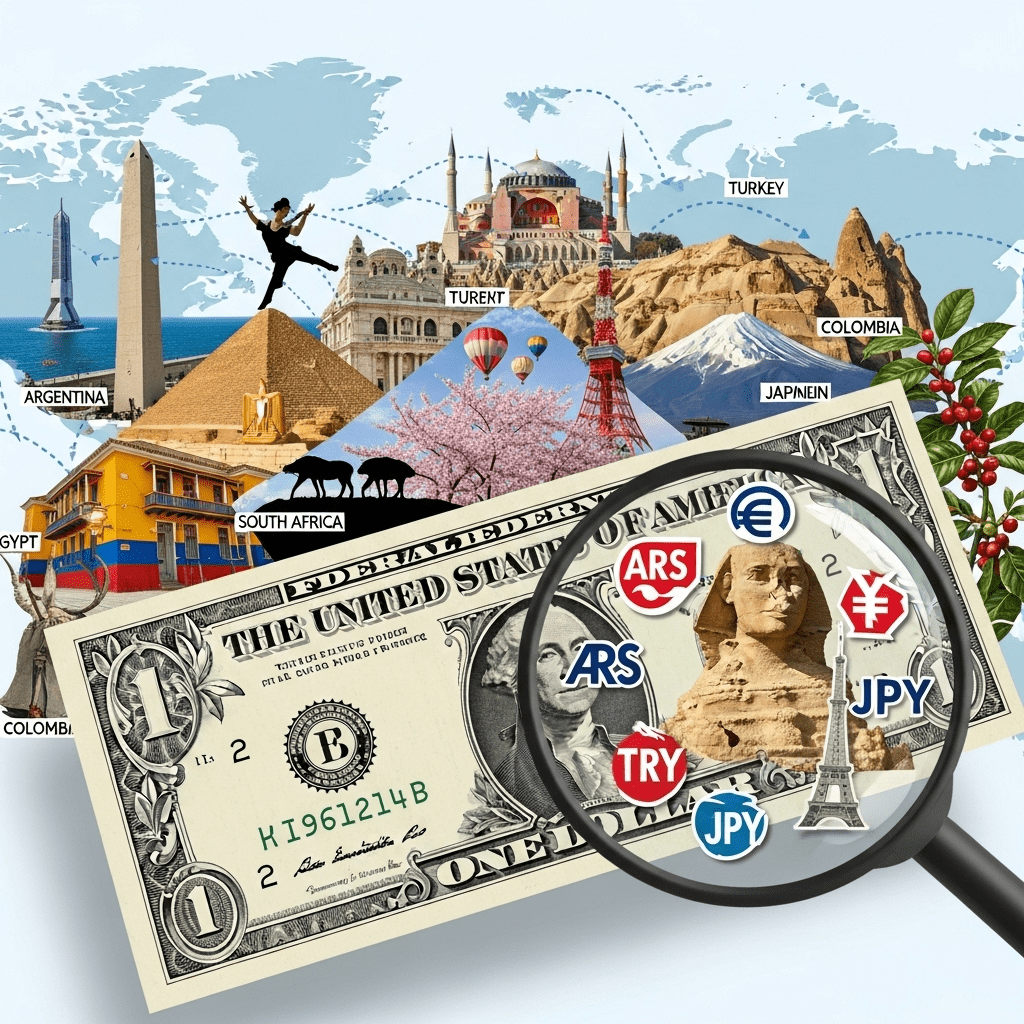

As global economies shift and currencies fluctuate, savvy tourists increasingly ask: where the US dollar is strongest for travelers right now? In 2025, your money can stretch further than ever in several destinations, offering outstanding value, exciting opportunities, and smart ways to make the most of your travel budget.

Where the US Dollar Is Strongest for Travelers Right Now

Travelers want their hard-earned money to unlock unforgettable experiences abroad without breaking the bank. Favorable exchange rates—and inflation management by central banks—mean some countries offer exceptional value for Americans this year. Monitoring trends and leveraging research from FX analysts at major banks, we spotlight the regions and countries delivering the most purchasing power for US visitors today.

1. Argentina: Opportunity in Economic Volatility

Argentina’s peso has experienced substantial devaluation due to persistent inflation and economic restructuring. For 2025, US dollars go further than ever in Buenos Aires, Patagonia, and Mendoza—covering everything from gourmet dining and luxury stays to adventure tours at a fraction of US prices. Currency controls mean you should seek trustworthy, legal currency exchange venues; official exchange rates remain more favorable than secondary markets. For more tips on smart spending abroad, check our personal finance resources.

2. Turkey: Exotic Experiences on a Budget

Turkey’s lira reached new lows through 2024, making Istanbul, Cappadocia, and the Turkish Riviera accessible and affordable. While local inflation has impacted some living costs for residents, foreign visitors benefit from generous exchange rates. Whether it’s Michelin-starred dining or luxury stays along the Aegean, your travel dollars go much further than in Western Europe.

3. Japan: Exceptional Value in Asia

The Japanese yen is at its most favorable exchange rate against the dollar in decades. For travelers, this translates to affordable rail passes, high-quality sushi, and even luxury accommodations in Tokyo and Kyoto for less. The Bank of Japan’s continued focus on monetary stimulus keeps the yen relatively weak, offering ongoing value for US tourists. For context on how exchange rates impact investing, visit our in-depth global market analysis.

Other High-Value Destinations for 2025

Beyond Argentina, Turkey, and Japan, several destinations also stand out when considering where the US dollar is strongest for travelers right now:

4. Egypt

The Egyptian pound has declined steadily, making ancient wonders, Red Sea resorts, and Nile cruises especially affordable. US visitors find accommodation, transport, and experiences well-priced, provided they approach unofficial exchange offers with caution.

5. South Africa

The South African rand remains undervalued, meaning safaris, Cape Town fine dining, and vineyard tours come at a discount compared to similar experiences elsewhere. Fixed-dollar costs such as flights may remain steady, but local expenses can yield substantial savings.

6. Colombia

Colombia’s peso persistently trades at favorable rates versus the dollar, placing Medellin’s innovation scene and Cartagena’s colonial charm within easy, affordable reach for American tourists. The low cost of food and accommodation, combined with developing tourism infrastructure, make it a must-consider option in Latin America.

What Drives Favorable Exchange Rates for Travelers?

Currency strengths are determined by macroeconomic factors including interest rates, inflation, trade balances, and global investor sentiment. In 2025, the US Federal Reserve’s policy, contrasted with less hawkish approaches in emerging economies, keeps the dollar robust against several currencies. Volatility in Latin America, monetary stimulus in Asia, and regional conflicts can prompt rapid FX swings. International travelers should monitor real-time currency fluctuations and beware of hidden costs: always use official banking channels or reputable providers when exchanging currencies abroad to avoid scams and unfavorable rates.

Maximizing Your Travel Budget: Practical Tips

- Monitor currency moves before booking flights and hotels; rates can shift in weeks.

- Prepay major expenses at current exchange rates where possible.

- Consider using multi-currency debit cards or travel credit cards with no foreign transaction fees.

- Stay informed: Government travel advisories and economic news will help you avoid regions with sudden instability.

For more in-depth financial planning techniques, our team at ThinkInvest.org provides updated investment insights to ensure your resources go even further, whether at home or abroad.

Conclusion: Travel Smart Where the US Dollar Is Strongest

With the US dollar offering unprecedented strength in select global markets, 2025 is an ideal time for budget-minded American travelers to explore new destinations. Keep abreast of real-time exchange trends, manage your travel budget with reliable tools, and consult trusted financial experts to further maximize your journey. By understanding where the US dollar is strongest for travelers right now, you’ll unlock greater value and unforgettable experiences throughout the year.