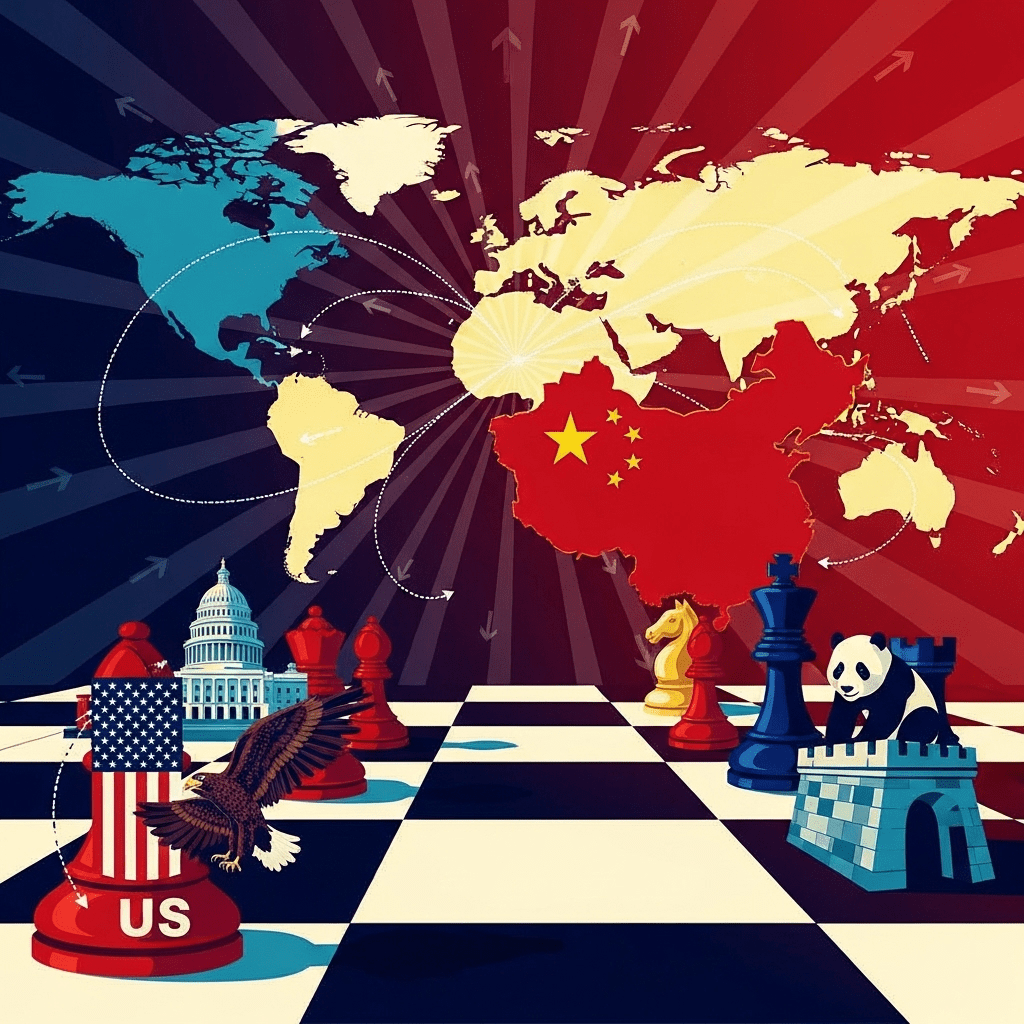

As the 2024 U.S. presidential election cycle intensifies, trade policy is again taking center stage. Many analysts argue that China is well positioned for a trade showdown with Trump if the former president returns to the White House. With stronger domestic industry, diversified supply chains, and robust fiscal reserves, China has spent years preparing for renewed economic tensions with the United States.

Why China Is Well Positioned for a Trade Showdown with Trump

During Trump’s previous administration, an aggressive tariff campaign against Chinese imports triggered a multi-year trade war. Since then, China has moved strategically to strengthen its economy. It has invested heavily in domestic innovation, deepened trade with alternative partners, and implemented key fiscal reforms. Together, these measures help cushion the impact of external shocks and reduce exposure to future U.S. tariffs or sanctions.

Supply Chain Diversification and Self-Reliance

China’s resilience starts with its sweeping effort to diversify global supply chains. By expanding trade ties with Southeast Asia, Africa, and Latin America, China has lowered its dependence on U.S. markets. Programs such as the Belt and Road Initiative not only foster new partnerships but also secure access to raw materials and create new export destinations. This broad diversification gives Beijing more flexibility in navigating trade disruptions.

Technological Advancement and Import Substitution

China’s long-term “Made in China 2025” strategy continues to bear fruit. The policy has accelerated growth in sectors like semiconductors, electric vehicles, renewable energy, and artificial intelligence. Massive state-backed investments have allowed local firms to develop advanced technologies once sourced primarily from the West. This progress strengthens national security while reducing exposure to foreign supply risks.

China’s Fiscal Strength as Trade Tensions Loom

Fiscal and monetary stability further reinforce China’s position. By late 2024, the country’s foreign exchange reserves exceeded $3 trillion—ample capacity to stabilize the yuan and absorb potential trade shocks. The People’s Bank of China has adopted prudent policies to contain inflation, stimulate manufacturing, and support exporters. This financial flexibility ensures that China can respond swiftly to any escalation in trade disputes.

Domestic Consumption Drives Resilience

China’s pivot toward domestic consumption also adds strength. Recent data from the National Bureau of Statistics show continued growth in retail sales and services, even amid global uncertainty. By prioritizing internal demand, Beijing has made the economy less dependent on external trade. This domestic engine provides stability against potential tariffs or global downturns.

Implications for Global Investors and Markets

For investors and analysts, understanding why China is well positioned for a trade showdown with Trump is essential for effective risk management. Renewed trade friction could create volatility across equity and currency markets. However, China’s diversified economy and adaptable supply chains suggest that systemic disruption may be limited. As a result, global investors are reassessing opportunities in emerging markets and technology sectors shielded by domestic policy support.

For continuous updates on global market dynamics, visit expert market analysis at ThinkInvest.org.

Geopolitical Considerations and a Multipolar Trade Landscape

Beyond economics, China is actively shaping a multipolar trade environment. The expansion of the digital yuan and growing non-dollar trade agreements with energy-rich partners are part of this shift. These moves reduce reliance on the U.S. dollar and enhance China’s strategic autonomy. Investors should monitor these developments closely for insights into currency trends and long-term geopolitical realignments.

For deeper context, explore ThinkInvest.org’s global investment insights.

Conclusion: Strategic Preparedness and Investment Implications

As 2025 unfolds, both policymakers and investors must recognize that China is well positioned for a trade showdown with Trump. Through industrial reform, fiscal strength, and diversified global engagement, China has built a resilient foundation for any renewed trade conflict. While uncertainty persists, understanding these dynamics remains vital for strategic investment decisions. For exclusive updates on emerging markets, see ThinkInvest.org’s emerging market briefings.