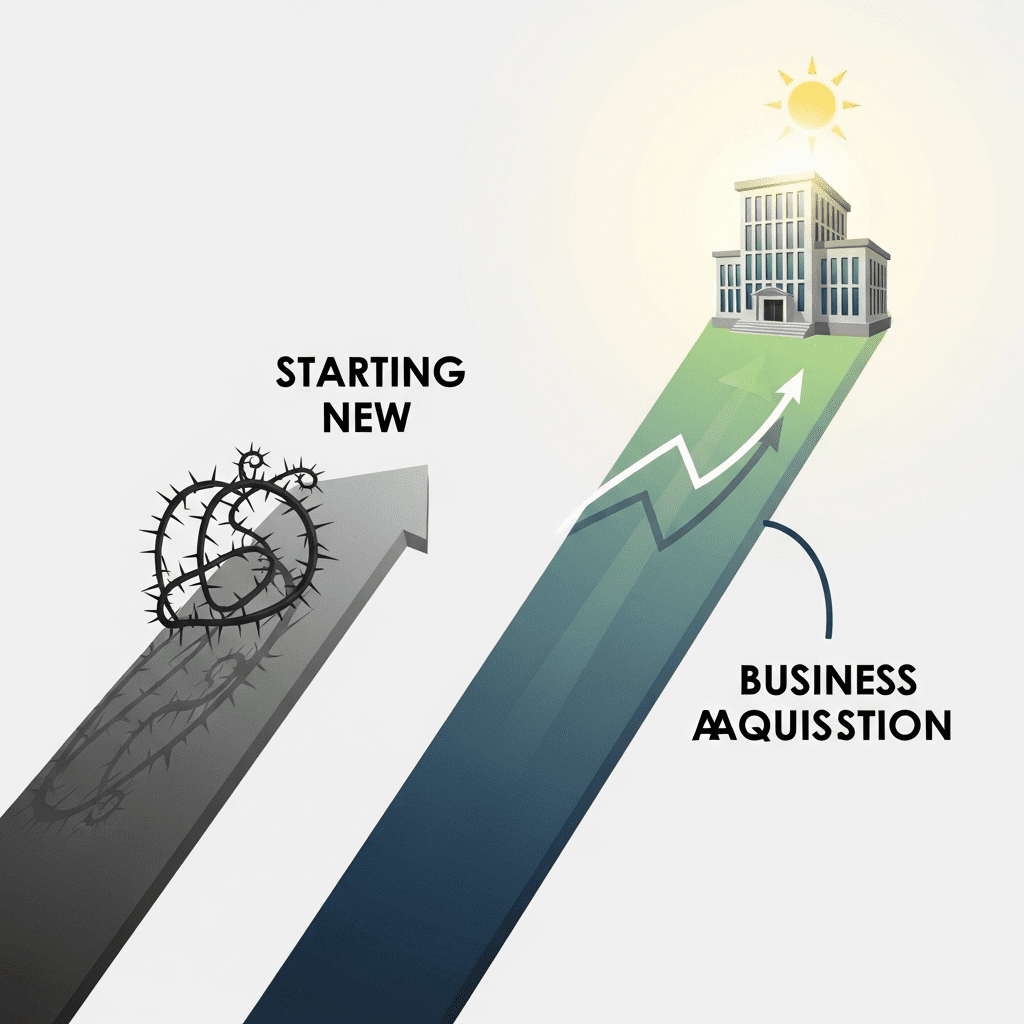

In today’s hyper-competitive market, many professionals are rethinking their path to entrepreneurship. For me, choosing business acquisition instead of starting from scratch was a strategic move—one increasingly embraced by savvy founders and investors. The reasons for this shift go far beyond risk avoidance: acquiring an established company offers unique advantages in scalability, proven revenue, and access to experienced teams.

Why Business Acquisition Instead of Starting Is Becoming the Smart Choice

Starting a business has long been the traditional entryway into entrepreneurship. But as market dynamics shift and access to capital tightens, professionals are recognizing the advantages of buying an existing business. Opting for business acquisition instead of starting anew often means sidestepping years of uncertain product-market fit, unstable cash flows, and the exhausting grind of building brand recognition from zero.

Roughly half of new businesses fail within five years, according to the Small Business Administration. In contrast, buying an established business with strong books, operational systems, and a loyal customer base dramatically reduces these risks. This model resonates with investors and those familiar with the complexities of growth strategy—they understand that profitability and scalability are easier to achieve with an operational foundation in place.

Immediate Cash Flow and Operational Track Record

One of the strongest arguments for choosing business acquisition over starting is immediate access to revenue streams. Unlike startups, which may struggle for months—or even years—to achieve profitability, an acquired business typically generates cash flow from day one. This operational runway allows new owners to implement improvements, expand services, or invest in technology upgrades, rather than focusing solely on survival.

The importance of an established track record cannot be overstated. Investors and lenders are more likely to fund growth or offer favorable terms when a company displays a consistent history of profitability. This opens up additional opportunities such as financing for expansion or competitive acquisition deals—opportunities rarely offered to startups with no earnings history.

The Appeal for Professionals: Risk Mitigation and Speed

The landscape of entrepreneurship has evolved. With more professionals opting for business acquisition instead of starting, a new set of advantages comes into play: speed and risk mitigation. Smart buyers can identify value opportunities, complete due diligence, and transition into leadership roles within months—not years.

For those leaving corporate roles or pursuing mid-career pivots, the security of acquiring a proven business is especially compelling. Acquisitions offer professionals ownership benefits with far less exposure to the pitfalls that plague most startups. As a bonus, inheriting a competent management team means the learning curve is far more manageable, enabling quicker implementation of growth strategies and a smoother transition for all stakeholders.

Unlocking Growth with Strategic Upgrades

Once established in the driver’s seat, new owners can focus on accelerating growth, leveraging the business’s infrastructure to launch new products or expand into untapped markets. This method aligns perfectly with the priorities of modern investors, who crave predictable returns and scalable models. For those interested in navigating new markets, resources like market entry guides can be invaluable.

Future Trends: The Rise of Search Funds and Group Acquisitions

Looking ahead to 2025, two trends stand out in business acquisition: the emergence of search funds and collaborative group acquisitions. Search funds—where individual entrepreneurs raise capital to find, acquire, and operate existing businesses—are attracting a diverse cohort of MBAs, former executives, and investors. The preference for business acquisition instead of starting is becoming a dominant approach among professionals aiming for ownership without the early-stage grind.

Additionally, group acquisitions allow small teams to pool resources, share operational responsibilities, and reduce individual risk. Both methods reflect a broader move toward efficiency, risk management, and smarter returns in the entrepreneurial ecosystem.

Conclusion: Is Business Acquisition the Right Move for You?

My decision to buy a business instead of starting one emerged from a careful analysis of risk, opportunity, and long-term strategy. For many professionals, especially in today’s landscape, the benefits of established cash flow, team experience, and market presence make acquisition increasingly attractive. With new models and more resources available, business acquisition instead of starting is poised to become the default path for future entrepreneurs—combining lower risk with faster, sustainable growth.