The cryptocurrency market has exploded in recent years, attracting millions of new investors worldwide. Unfortunately, this growth has also attracted scammers who steal billions of dollars annually from unsuspecting victims. According to recent reports, crypto scam losses exceeded $5.6 billion in 2023 alone.

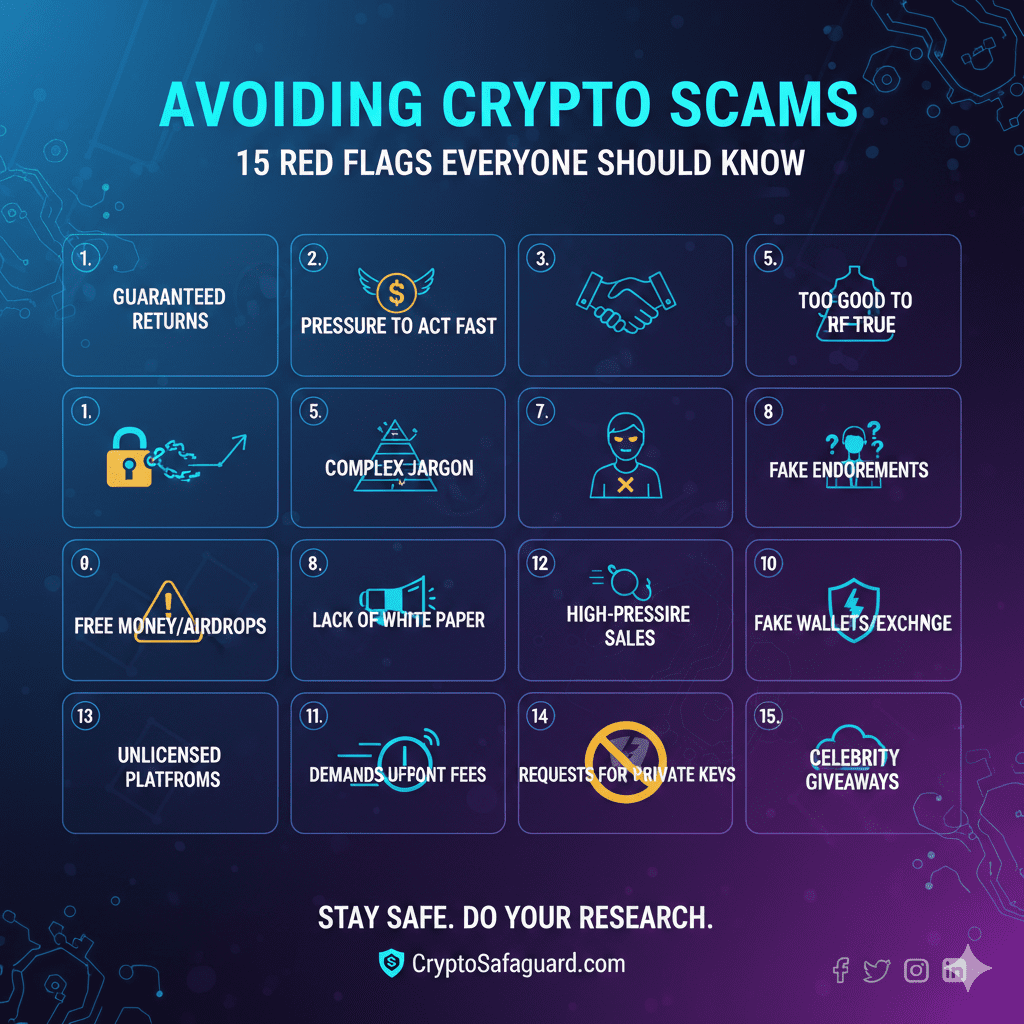

The good news? Most crypto scams follow predictable patterns. Once you know what to look for, protecting yourself becomes significantly easier. In this comprehensive guide, we’ll expose the 15 most critical red flags that signal a potential crypto scam, along with real-world examples and actionable protection strategies.

Table of Contents

- Guaranteed Returns and “Risk-Free” Promises

- Pressure to Invest Immediately

- Unsolicited Investment Offers

- Celebrity Endorsements (Especially Fake Ones)

- Poorly Written Whitepapers or No Whitepaper

- Anonymous or Fake Team Members

- Requests for Private Keys or Seed Phrases

- No Clear Use Case or Product

- Promises of Free Crypto or Giveaways

- Copycat Websites and Phishing Links

- Multi-Level Marketing Structure

- Lack of Transparent Tokenomics

- Unverified Smart Contracts

- Fake Volume and Wash Trading

- No Security Audits

1. Guaranteed Returns and “Risk-Free” Promises

The Red Flag: Any crypto project promising guaranteed returns, fixed daily profits, or claiming to be “risk-free” is lying.

Why It’s a Scam: Cryptocurrency markets are volatile by nature. Only Ponzi schemes make such promises—they pay early investors with money from new investors.

Example: BitConnect promised 1% daily returns and collapsed in 2018.

What to Do: Avoid all projects guaranteeing returns. Even legitimate staking programs carry risks.

2. Pressure to Invest Immediately

The Red Flag: Fake urgency like “only 10 spots left.”

Why It’s a Scam: Scammers push you into decisions without research.

Example: Fake ICOs using countdown timers.

What to Do: Legit opportunities do not require instant decisions.

3. Unsolicited Investment Offers

The Red Flag: Random DMs promoting “exclusive” crypto investments.

Why It’s a Scam: Real opportunities don’t appear in DMs.

Example: “Pig butchering” scams.

What to Do: Ignore unsolicited messages and avoid clicking unknown links.

4. Celebrity Endorsements (Especially Fake Ones)

The Red Flag: Claims that celebrities endorse a project.

Why It’s a Scam: Scammers forge endorsements using AI and deepfakes.

Example: Fake Elon Musk giveaways.

What to Do: Verify endorsements on official channels and research the project fundamentals.

5. Poorly Written Whitepapers or No Whitepaper

The Red Flag: Missing, vague, or plagiarized whitepapers.

Example: OneCoin used a fake whitepaper with no real blockchain.

What to Do: Read and compare to established project whitepapers.

6. Anonymous or Fake Team Members

The Red Flag: Hidden or fake team identities.

Why It’s a Scam: Scammers avoid accountability.

Example: Many DeFi rug pulls used stock images for team profiles.

What to Do: Verify team members and check LinkedIn history.

7. Requests for Private Keys or Seed Phrases

The Red Flag: Anyone asking for your private keys.

What to Do: Never share your seed phrase. Move funds if compromised.

8. No Clear Use Case or Product

The Red Flag: No real purpose, just hype and buzzwords.

Example: Meme coins with zero utility.

What to Do: Ask: “Does this solve a real problem?”

9. Promises of Free Crypto or Giveaways

The Red Flag: “Send 1 BTC, get 2 BTC back.”

Example: Twitter giveaway scams.

What to Do: Real airdrops never require payment first.

10. Copycat Websites and Phishing Links

The Red Flag: Fake sites mimicking real exchanges.

Example: Fake MetaMask and Ledger ads.

What to Do: Verify URLs, bookmark official sites, and learn to identify phishing attempts.

11. Multi-Level Marketing Structure

The Red Flag: Earnings based on recruiting others.

Example: PlusToken scam.

What to Do: Avoid pyramid-like structures. Real cryptocurrency investments don’t require recruitment.

12. Lack of Transparent Tokenomics

The Red Flag: Hidden supply, insider allocations, no vesting.

Example: Tokens where 90% of supply is controlled by one wallet.

What to Do: Research token distribution and verify with explorers.

13. Unverified Smart Contracts

The Red Flag: Unverified code on explorers.

Example: SQUID token prevented users from selling.

What to Do: Use only verified contracts. Learn smart contract security.

14. Fake Volume and Wash Trading

The Red Flag: Suspiciously high volume for unknown projects.

Example: Small-cap tokens faking millions in daily volume.

What to Do: Check holder distribution, real transactions, and compare with legitimate projects.

15. No Security Audits

The Red Flag: No audits or fake audit claims.

Why It’s Important: Audits detect vulnerabilities.

What to Do: Verify published audits from reputable firms.

How to Protect Yourself: Essential Security Practices

Use Hardware Wallets

Store crypto in hardware wallets for maximum security.

Enable Two-Factor Authentication

Use authenticator apps, not SMS.

Research Before Investing

Investigate any project thoroughly before sending funds.

Start Small

Test platforms with small amounts first.

Use Reputable Exchanges

See how to choose crypto exchanges for guidance.

Keep Software Updated

Update wallets, browsers, and devices regularly.

Trust Your Instincts

If something feels off, walk away.

What to Do If You’ve Been Scammed

- Stop communication with the scammers

- Document everything

- Report to IC3.gov, FTC.gov, and local police

- Report scam accounts on social platforms

- Warn others

- Secure remaining assets

- Seek legal help for large losses

Conclusion: Stay Vigilant in the Crypto Space

Recognizing these 15 red flags can protect you from devastating losses. Always research, stay skeptical, and verify everything before investing.